When Gwen Griggs finished law school, she was ready to solve problems.

She knew how to think critically. How to cut through complexity and get to answers fast. She was excited to use those skills.

Then her law firm gave her the real goal: 2,200 billable hours per year.

“The skills that I had learned in college and school to solve problems quickly weren’t the same skills that made you successful in a law firm,” she told me.

Here’s what hit me about that… She wasn’t describing a personal failure. She was describing a structural problem baked into the business model itself.

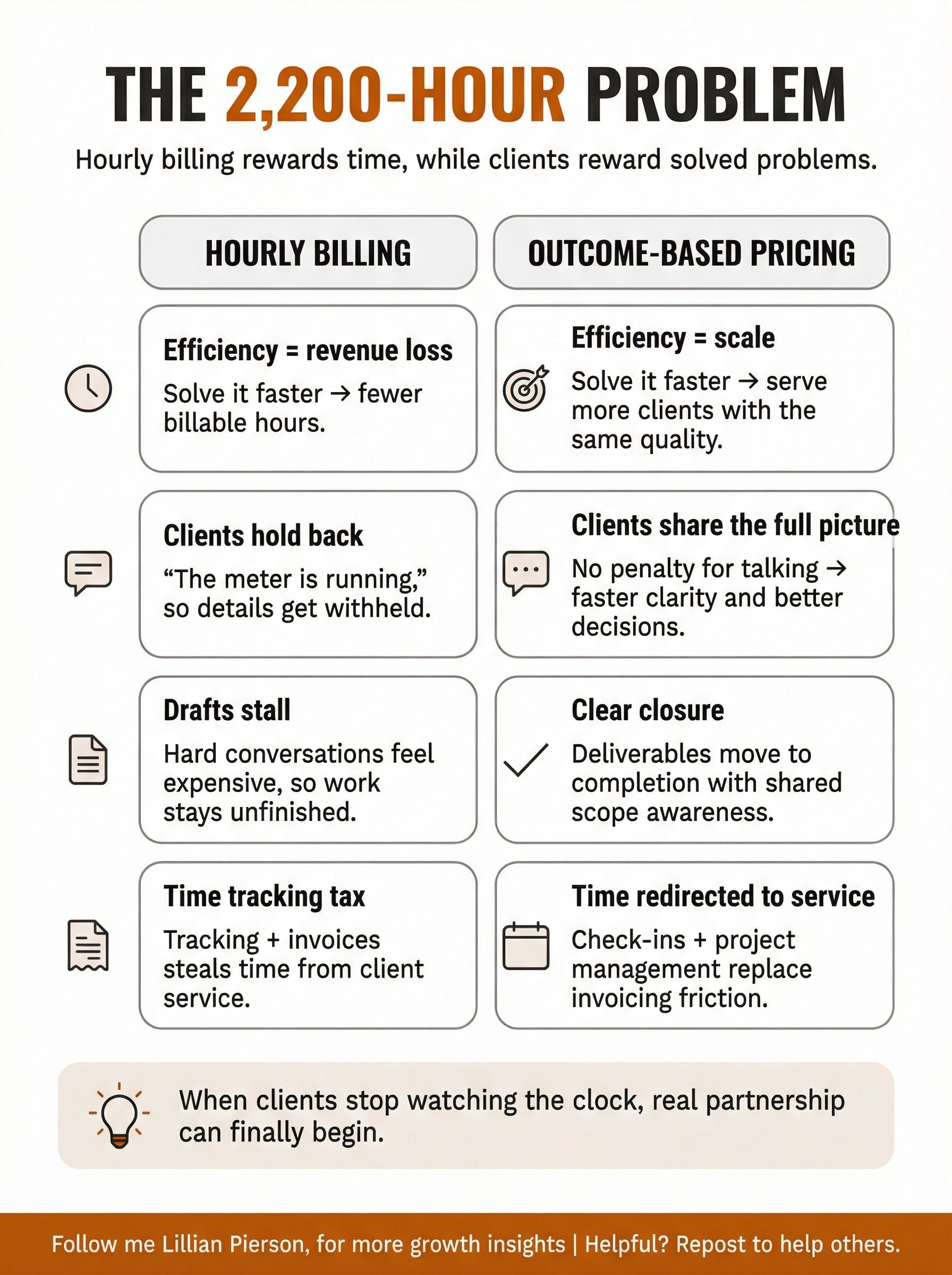

The firm wanted maximum hours. Clients wanted efficient solutions.

Those two things don’t just exist in tension; They’re fundamentally opposed to each other.

After more than 2 decades inside law firms and inside companies, Gwen spent the last 10 years figuring out how to build something different.

The Misalignment Nobody Talks About

Most professional services have this same invisible friction.

You bill by the hour. Your client wants their problem solved. Solve it too quickly? Less revenue for you. Solve it slowly? Frustrated clients who feel milked.

The hard part about it is that nobody’s really the villain here. Lawyers aren’t intentionally dragging their feet. Clients aren’t unreasonable for wanting efficiency.

But the system itself creates misalignment at every level.

Gwen saw this play out across three different contexts:

- At the big law firm: 2,200 hours per year, efficiency was the enemy

- As general counsel for a company: Lawyering without billing, strategic partnership

- Founding ADVOS Legal: Building the engagement model she wished existed

The general counsel experience was the breakthrough. Same legal work. Same problem-solving.

But suddenly she was part of strategic business decisions. Seeing around corners. Helping solve problems before they became bigger issues.

In other words, when billing friction disappeared, the relationship transformed from transactional to strategic.

So when she founded ADVOS Legal, she asked a different question: What if we just… didn’t bill by the hour?

What Replacing Hours with Outcomes Actually Looks Like

Surprisingly, ADVOS Legal doesn’t use flat fees or fixed fees either.

They use a point-based system that Gwen and her co-founder adapted from Agile Scrum methodology – an approach shaped not only by their own experience but also by extensive input from their clients, many of whom are tech founders themselves.

Every legal project gets broken down into granular steps.

… First round letter of intent.

… Second round letter of intent. Contract negotiation. Diligence review.

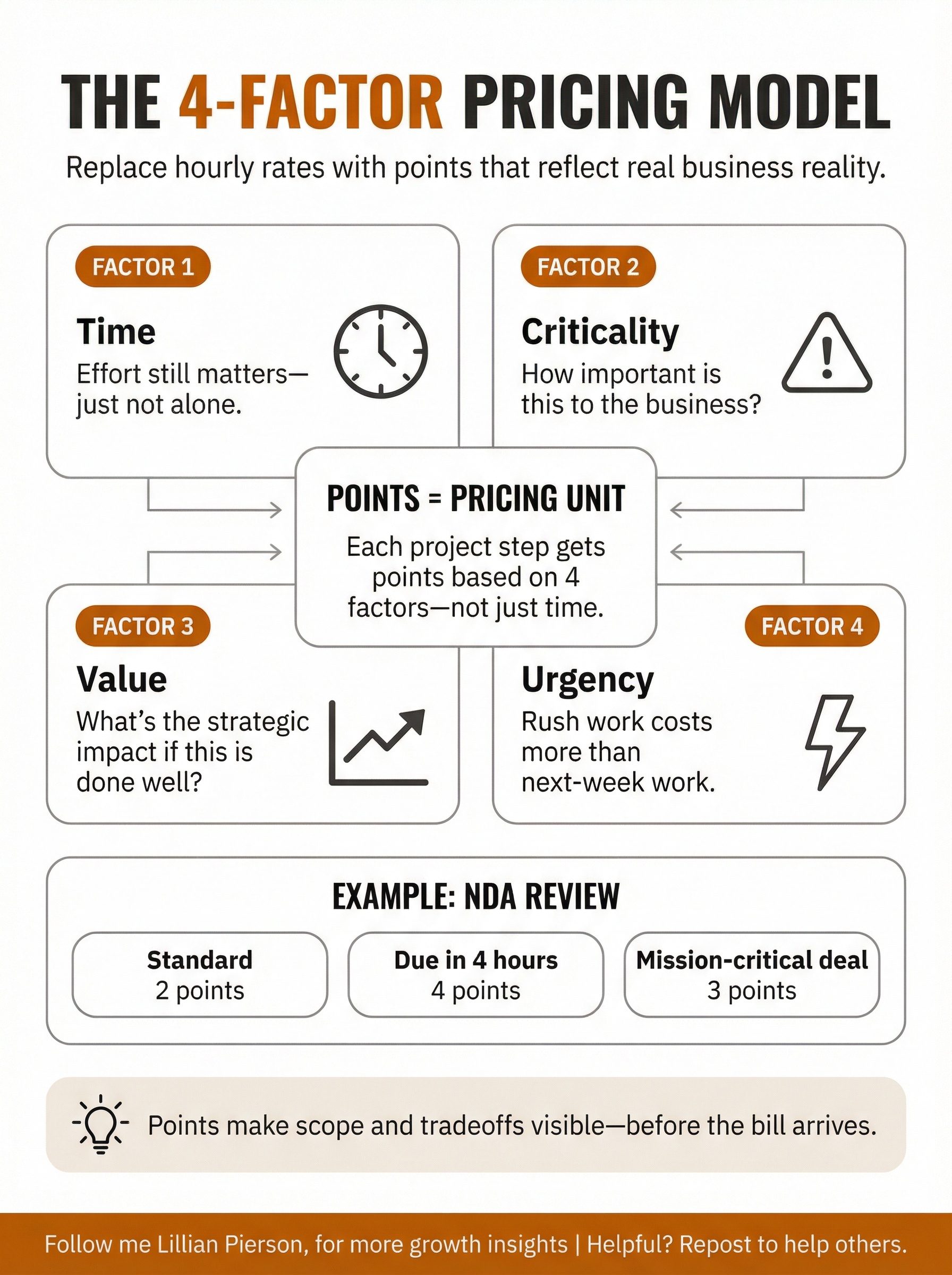

Each step has a point value based on four factors:

The Four-Factor Pricing Model:

- Time: Still matters, it’s just not the only thing

- Criticality: How important is this to the business?

- Value: What’s the strategic impact?

- Urgency: Need it tomorrow? That’s more points than need it next week

Gwen can give clients a range at the start based on extensive experience. As work progresses, she tracks whether they’re on the high or low end of that range.

When new complexity emerges, like difficult opposing counsel or unexpected diligence issues, she communicates that to her client immediately.

The difference here is that clients aren’t surprised by bills. They’re informed partners in managing scope and cost throughout the process.

Take NDAs as an example. Standard NDA review might be 2 points. Same NDA but you need it in 4 hours? 4 points. Same NDA but it’s for your biggest customer and mission-critical? 3 points.

That’s outcome-based pricing. You’re not paying for hours. You’re paying for solved problems, with transparent pricing that reflects actual complexity and business value.

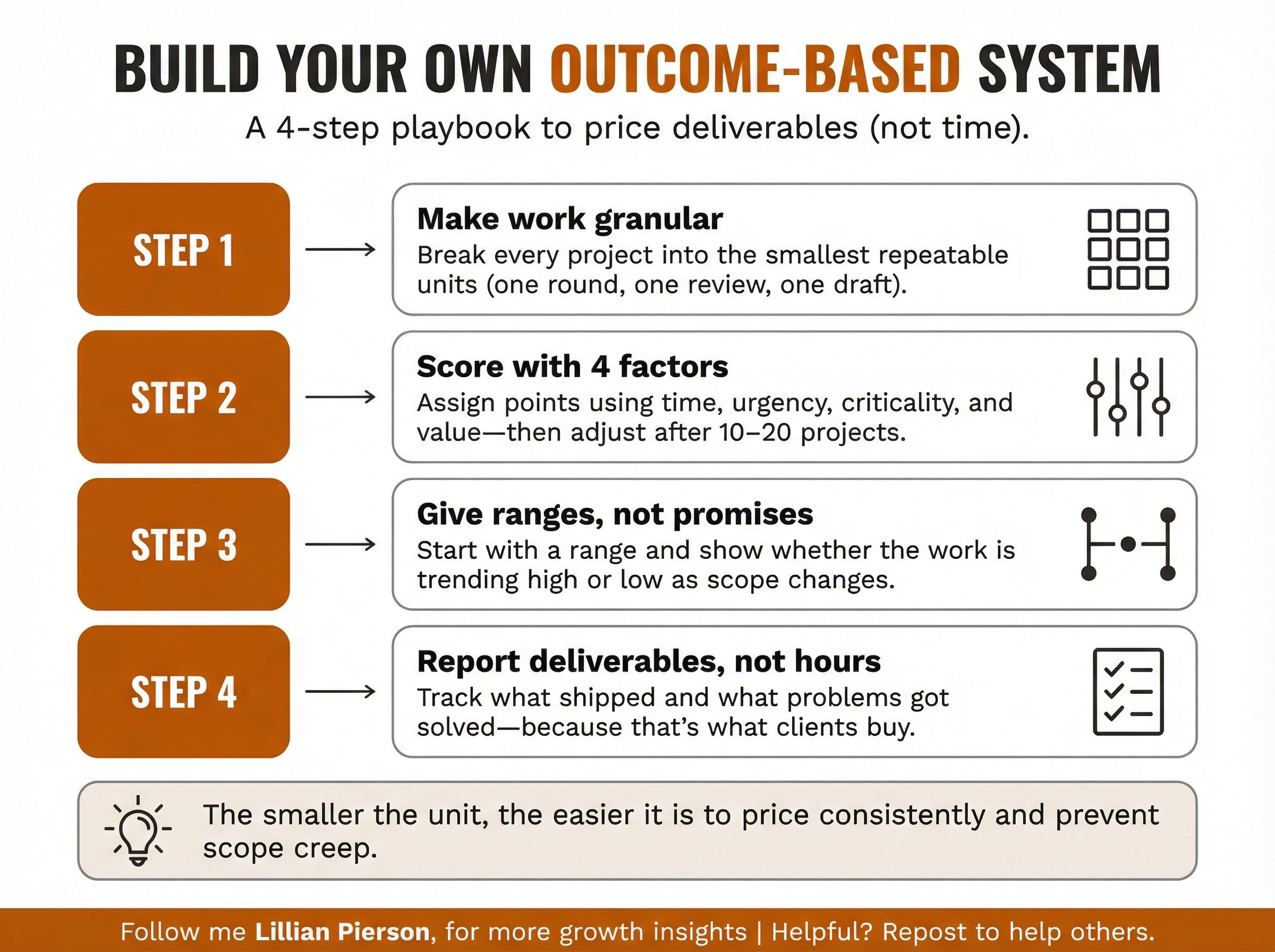

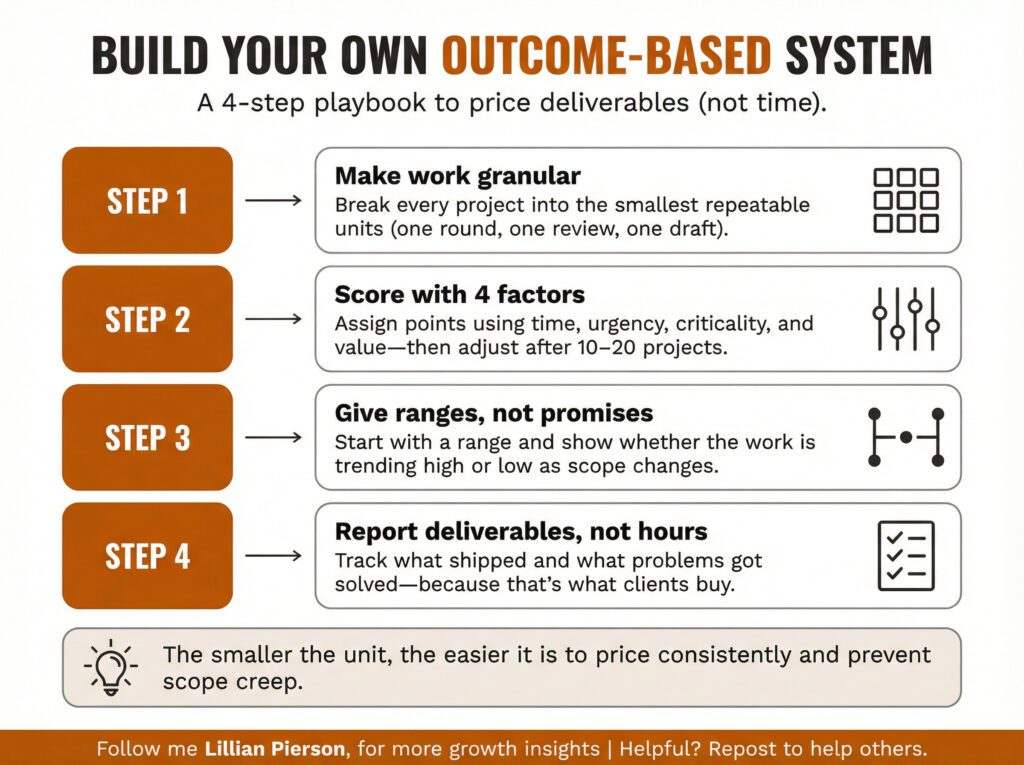

Steal This: Building Your Own Outcome-Based System

You don’t have to own a law firm to use this framework. The following describes how to adapt this system for your own business.

Step 1: Break every project into smallest possible units

For ADVOS, that’s “one round of letter of intent negotiation” or “IP assignment review.”

For a marketing consultant, it might be “competitor analysis,” “messaging framework,” “landing page copy.”

For a fractional CFO, “cash flow model,” “board deck,” “fundraising strategy.”

The point is granularity. The smaller the unit, the easier it is to price it consistently.

Step 2: Assign point values based on the four factors

Time matters. But, as mentioned above, so does urgency (rush work costs more), criticality (business-critical work costs more), and value (strategic impact matters).

Build a points matrix. Test it with 10-20 projects. Adjust based on what you learn.

Step 3: Give ranges, not fixed prices

Gwen doesn’t promise exactly what an M&A transaction will cost. She gives a range based on experience, then tracks progress throughout.

Clients can see whether they’re trending high or low in real-time.

This solves the “scope creep” problem without falling back into hourly billing.

Step 4: Report on deliverables, not hours

Replace time tracking with deliverable tracking. What did we actually accomplish? What problems did we solve?

That’s what clients care about.

ADVOS reports, “We delivered this contract. We negotiated this agreement. We solved this problem, and that is worth two points.”

Compare that to, “We spent 14.7 hours on your matter this week.”

Which one feels more like a partnership?

What Happens When Billing Friction Disappears

Here’s what surprised me most about Gwen’s story… when she adopted this novel engagement model. Her client relationships were radically transformed in the best of ways.

Gwen told me about clients who’d gone to other lawyers, started projects, and could never get them across the finish line. They had draft operating agreements sitting in limbo.

Why?

Because the billing model created a barrier to the very conversations needed to finish the work.

Clients withheld information to control costs. Lawyers optimized for time tracking instead of problem completion.

Projects stalled because the client didn’t want to “run up the meter” having the conversations that were truly needed to reach closure.

When ADVOS removed that friction, everything changed:

- Time previously spent on time tracking and invoicing → Redirected to client service, regular check-ins, project management

- Clients worried about “the meter running” → Clients sharing complete information because there’s no penalty for communication

- Lawyers staying distant from daily operations → Lawyers becoming strategic partners who understand the business deeply

- Projects stalling in draft form → Projects reaching actual completion with clear closure

Gwen put it simply, “If you take all of the time it takes to track your time and send out invoices and detailed invoices and make sure they match, that’s not insignificant. If you repurpose all of that time to client service, now we have meetings. We have regular check-ins. We’re making sure the projects are moving along.“

Or put another way, the administrative overhead of hourly billing isn’t just internal cost. It’s opportunity cost – the time you could be spending deepening client relationships and solving bigger problems.

The AI Adoption Paradox

ADVOS Legal is bullish on AI. Spellbook for legal-specific work. Westlaw and Lexis with AI features. Every efficiency tool they can get their hands on.

Why? Because they’re not disincentivized by efficiency.

Think about the hourly billing trap… If you’re a lawyer billing $500/hour and AI cuts your work time in half, you just cut your revenue in half. You’re literally incentivized against using the tools that would better serve your clients.

When most people hear “AI will transform professional services,” they think about job displacement.

The real story is weirder however. Hourly billing makes AI adoption a threat to your business model.

Gwen doesn’t have that problem. AI makes her and her team fast, which means she can serve more clients at the same quality level.

Or spend more time on the strategic conversations AI can’t handle – negotiation strategy, understanding human behavior, helping clients think through how to solve problems.

The thing is, AI is really good at a lot of what lawyers historically did. Document drafting. Contract review. Research. Basic analysis.

But AI isn’t good at judgment calls that require business context. Which terms in this NDA actually matter given this specific relationship dynamic? How should we position this negotiation given what we know about the other side?

What’s the strategic play three moves ahead?

That’s where ADVOS adds value. And because they’re not billing hours, they can let AI handle everything else without worrying about revenue.

Gwen and her team do several NDAs a day. AI helps with the standard elements. But the human judgment – are you the discloser or recipient? Talking to an investor, customer, or vendor? Are you the small fish or big fish in this relationship? – that still requires her expertise.

Junior staff can use AI to get work done faster, which frees them up for more interesting, higher-value work. Training accelerates. Paralegals can tackle more complex projects with AI support.

However, if you were billing their hours, this would be a problem. You’d be incentivized to keep them doing manual work longer.

Maintaining Quality Without Hourly Oversight

Of course, moving faster only works if you maintain quality. ADVOS solved that by building a QA credit system into their project management platform.

Here’s how it works:

Every deliverable has a QA field. If a paralegal delivers client-ready work to a partner, the paralegal gets the QA credit.

If the work isn’t client-ready and requires fixes, whoever fixes it gets the QA credit.

Simple. But brilliant in its incentive structure.

Non-client-ready work triggers three possible conversations. Those are:

- Coaching need: You didn’t do a good job, I need to coach you on what client-ready means in this context

- Training gap: You don’t actually know the material well enough yet, we need better training

- System problem: Our instructions or templates didn’t give you what you needed to succeed

All three are opportunities for improvement. None are emotional confrontations about quality.

Gwen told me, “All of those are just opportunities for us to have the conversation that so many people don’t want to have. Right. They just want to go fix it, complain about it.

But in our system, we are incentivized to deliver client-ready work. It’s not going to be poor work. But now I’m training people, improving our system, and making it not all wrapped up in emotion.”

In other words, the QA system removes emotion from quality feedback by making it transactional. You either delivered client-ready work and you get the credit, or you didn’t and you don’t get the credit, plus we figure out why together.

This is how you scale quality without micromanaging hours.

The Hidden Value Killers in M&A Deals

After three decades of M&A work, including one decade at ADVOS Legal, Gwen kept seeing the same heartbreaking pattern.

Founders would get to the letter of intent stage. Everything looked good. Then diligence would start.

And their acquisition value would get whittled down because of completely avoidable issues they simply didn’t know about.

Cap tables that didn’t match the documentation. IP assignments missing from key contributors – that freelancer who helped with your logo three years ago? You never got an IP assignment.

Material contracts that couldn’t be assigned to a buyer. Workforce classification issues.

None of these were complicated.

In fact, they were simple. The founders just didn’t know.

“It was heartbreaking to watch people not knowing simple things that if they had done, we wouldn’t be having the conversation about how to reduce the value or mitigate the risk,” Gwen said.

This led her to launch Deal Advantage – a separate business focused on getting founders “deal ready” 2-3 years before acquisition.

The timeline matters. Two to three years gives you time to fix issues and demonstrate to buyers that you’re an experienced seller who knows what you’re doing.

Buyers pay more when they see clean documentation and good practices.

This is not even about getting a better deal. It’s about not losing value unnecessarily.

Buyers won’t accept risk they don’t have to accept. If your cap table is messy, they’ll reduce the purchase price or make it contingent on future performance.

If you can’t assign your major customer contracts, that’s a problem. If your IP ownership is unclear, they’ll adjust the terms.

All of those adjustments mean less cash for you at closing. And most of them are fixable with enough lead time.

Steal This: The Seven Pillars of Deal Readiness

Here’s the framework Gwen uses with Deal Advantage clients. Even if you’re not planning an acquisition, this is a useful audit of your startup’s legal foundation.

Don’t let this list overwhelm you. Most founders only have issues in 2-3 categories. But you need to know all seven to audit properly.

- Financial (you probably know this one)

Clean books and records. Proper accounting. No surprises. Most founders know that this matters.

- Cap Table

This trips up even large corporations. Your cap table needs to match your documentation exactly.

Every investment round, every option grant, every conversion – documented and reconciled.

Buyers look at this first. Messy cap table signals other problems.

- Intellectual Property

You need IP assignments from every single person who contributed to your code, design, copy, or other creative work. That includes:

- Founders

- Early employees

- Contractors and freelancers

- Advisory board members

- Anyone who touched your IP

Missing even one assignment can create complications during diligence.

- Material Contracts

Your customer agreements, vendor contracts, partnership deals – buyers will review all of them. Key questions:

- Can these contracts be assigned to a new owner?

- Are there change-of-control provisions?

- What are the terms and are they market-standard?

If your biggest customer contract can’t be assigned, that’s a huge problem.

- Insurance History

What coverage have you maintained? Any gaps? Any claims? Buyers want to understand risk exposure.

- Compliance

Depends on your industry, but this covers regulatory compliance, data privacy, security practices, and similar requirements. Document everything.

- Workforce

Did you classify employees vs. contractors correctly? Did you pay everyone properly? Any employment issues or disputes?

These come up in diligence and can significantly impact value.

The DIY version: If you’re not ready for Deal Advantage yet, Gwen suggests using Claude or ChatGPT to generate a diligence checklist and self-audit against it.

Try asking: “Give me a comprehensive M&A diligence checklist for a B2B SaaS startup with 50 employees and $5M ARR. Break it into categories and flag the most common issues you see.”

Not perfect, but it’ll surface major gaps.

The point is awareness. Most of these issues are fixable with time. But you need to know they exist.

How These Lessons Scale Far Beyond Legal Services

I keep thinking about the broader principle here.

Gwen built a new law firm business model because hourly billing misaligned incentives. But that same misalignment exists across most professional services.

Marketing consultants’ billing hours are incentivized to spend more time, not get better results faster. Fractional executives’ billing hours benefit from longer engagements, not efficient problem-solving.

Any service business charging for time faces the same structural tension.

The question isn’t whether hourly billing is “bad.” It’s whether your business model aligns your success with your clients’ success.

When ADVOS adopted outcome-based pricing:

- AI adoption became an advantage instead of a threat

- Client relationships transformed from transactional to strategic

- Quality improved through systems rather than hourly oversight

- The firm could optimize for client outcomes without worrying about revenue

That alignment creates compounding advantages over time.

Your clients want their problems solved efficiently. You want sustainable revenue. The business model you choose either aligns those two things or puts them in opposition.

Most professional services operate in opposition without really thinking about it.

Lillian

P.S. There’s a moment in every ADVOS client relationship that Gwen watches for.

It’s when the client stops worrying about “running up the meter” and starts actually sharing what’s going on in their business. The complete picture. The messy details.

The things they’d normally hold back to control costs.

That’s when the real work can begin. That’s when she can actually see around corners and help them avoid problems before they become expensive disasters.

The billing model they chose made that moment possible. Not by being generous or charitable, but by aligning incentives properly from the start.

I think about this every time now I structure my own client engagements. The moment someone stops thinking about the clock is the moment real partnership begins.

Want to get your startup deal-ready before acquisition talks begin? Learn more about Deal Advantage

If you’re interested in legal representation and support, learn more about ADVOS Legal here.

Lastly, Gwen and her co-founder also have a program to help lawyers and other types of professional consultants to redesign their practices around the outcome-based pricing model that they developed. That program is called ADVOS Pro – learn more about it here.

Tools and resources mentioned: Spellbook for legal AI, Westlaw and Lexis for legal research with AI features, Claude and ChatGPT for DIY diligence checklists.