Here’s the deal: If you’re building a startup in 2026, choosing the right revenue model isn’t just about making money – it’s about staying in the game. With AI reshaping costs, customer expectations, and business strategies, what worked yesterday won’t cut it today.

The big shift? Startups are moving away from flat pricing and leaning into models that align revenue with value delivered. Think usage-based plans, hybrid bundles, and AI-powered platforms. These models aren’t just trendy – they’re built to handle today’s demand for scalability and efficiency.

What you’ll learn here:

- The top 7 revenue models driving profits in 2026

- Why AI-first startups face unique cost challenges

- How to balance predictable income with growth potential

Here’s a quick overview of the top revenue models:

- Subscription SaaS Licensing: Reliable recurring income, great for scaling.

- Usage-Based Pricing: Revenue grows as customers use more.

- Freemium to Paid: Low-cost user acquisition with upsell opportunities.

- Tiered Enterprise Licensing: Custom pricing for big clients, higher margins.

- Transaction/Marketplace Models: Fees per transaction, ideal for platforms.

- Hybrid Product + Services: Combines software with consulting or support.

- Data and Platform Fees: Monetizing insights and AI-driven outcomes.

Why it matters: Aligning your revenue model with your product, costs, and customer base is the fastest way to scale profitably. Let’s break it down.

I Ranked Business Models that Will Make You Rich in 2026

sbb-itb-e8c8399

What Makes a Revenue Model Profitable in 2026

Profitability in 2026 revolves around five key factors: revenue predictability, gross margin potential, CAC payback speed, sales complexity, and upsell opportunities. These drivers are essential for aligning revenue models with sustainable growth. For AI startups, consumption-based pricing is becoming the norm as it better matches revenue with the high infrastructure costs they face [11]. While traditional SaaS companies typically enjoy gross margins between 70% and 85% [8], AI-driven platforms are grappling with a different reality – compute and infrastructure expenses can consume up to 75% of their revenue [11].

Unlike traditional software, where marginal costs per interaction are nearly zero, AI products come with significant per-interaction costs [11]. OpenAI serves as a prime example: by mid-2025, it reached $13 billion in MRR vs ARR but reported an $8 billion loss due to $6.7 billion in R&D expenses and heavy infrastructure spending [11]. This economic pressure is driving a shift in pricing strategies. By 2025, 59% of software companies expect usage-based pricing to dominate [11], reflecting how AI is reshaping traditional cost structures.

"For every $1 spent on AI model development, expect $3 in change management costs." – McKinsey, September 2025 [11]

CAC (customer acquisition cost) payback remains a critical metric. Digital startups aim for payback periods of 5–12 months [8], but AI and deep-tech companies often face longer timelines. For every $1 spent on development, they may need to allocate $3 for support [11]. Enterprise AI solutions, which often use outcome-based pricing, typically involve longer sales cycles but also allow for upsell premiums ranging from 30% to 110% above base subscription rates [11]. This financial dynamic is driving a move away from traditional seat-based pricing toward consumption-based models.

This shift highlights a broader market transformation. As AI boosts efficiency and reduces reliance on human users, traditional per-seat pricing models are becoming less viable [11][7]. For instance, Klarna’s OpenAI-powered assistant managed 2.3 million monthly conversations in 2024, effectively replacing the workload of 700 full-time agents and contributing an estimated $40 million in annual profit improvements [11]. Such efficiency gains underscore why leading organizations now generate 11% of their revenue from data monetization – a figure five times higher than that of less successful peers [7]. These trends will play a vital role in evaluating the revenue models discussed next.

1. Subscription SaaS Licensing

In the competitive landscape of 2026, Subscription SaaS Licensing continues to be a reliable approach for generating scalable and steady revenue.

Revenue Predictability (MRR/ARR Potential)

Subscription SaaS licensing has become synonymous with predictable income streams. In fact, this model accounts for 75% to 90% of total revenue through recurring payments [12]. Investors are drawn to this stability, as it provides a solid financial foundation. A prime example is Salesforce, which reported $26.492 billion in annual revenue for 2022 – a 24.66% year-over-year increase – by utilizing tiered subscription structures tailored to different customer needs [4].

The subscription economy has expanded by over 435% in the past decade [14], and projections suggest that by 2025, 85% of all business applications will operate as SaaS solutions [12]. Automated systems for billing and analytics further enhance this model by predicting renewal rates, identifying churn risks, and uncovering upsell opportunities. Additionally, annual discounts help ease cash flow challenges [12] [14]. This steady revenue stream is crucial for assessing profitability in both traditional and AI-driven SaaS models.

Gross Margin Profile (AI-First vs Classic SaaS)

Traditional SaaS businesses typically achieve gross margins between 70% and 85% [8], benefiting from low hosting and maintenance costs. However, AI-first SaaS platforms face a different set of financial dynamics. Unlike classic SaaS tools, which have minimal ongoing costs after deployment, AI-first platforms must handle continuous compute expenses, model retraining, and the scaling of infrastructure [7].

Ben Ellencweig from McKinsey & Company highlights that "intelligence is emerging as the new currency" [7]. Walmart Data Ventures’ Scintilla platform is a compelling example of success in this space. In October 2024, the platform reported 173% year-over-year customer growth and a 100% renewal rate, with customers committing to three-year contracts [7]. By leveraging proprietary shopper behavior data to deliver automated recommendations, Scintilla shows that when AI delivers measurable outcomes, customers are willing to commit long-term, helping to offset the higher costs associated with AI-first models.

CAC Payback and Sales Complexity

The customer acquisition cost (CAC) payback period for subscription SaaS typically ranges from 5 to 12 months, with an average customer lifetime of 31 months [8]. Low-touch sales models, featuring self-service onboarding and automated account management, help keep acquisition costs low. On the other hand, high-touch enterprise sales, which involve tailored demos and detailed negotiations, come with longer sales cycles but are justified by the larger contract values they bring.

Startups can simplify sales by focusing on niche markets or specific workflows through Vertical SaaS and Micro-SaaS strategies. This approach not only reduces competition but also builds stronger customer loyalty and pricing power. By 2026, 75% of SaaS companies are expected to use AI to automate key business processes, enabling them to scale without proportionally increasing headcount or costs [2]. Streamlined customer acquisition strategies open doors for upselling and expansion, driving sustained growth.

Upsell and Expansion Potential

Expansion revenue is one of the most efficient ways to grow in a subscription-based model. Upselling encourages customers to shift to higher-tier plans as their needs grow, while cross-selling introduces complementary products [12]. Even a 5% reduction in churn can boost a company’s long-term valuation by 25% to 95% [12]. Slack exemplifies this strategy, achieving $1 billion in revenue faster than any other SaaS company since its 2013 debut, thanks to its tiered subscription model that supported team expansion [8].

Timing is critical for successful upselling. Customers should first experience success with the core product before being introduced to premium features [12]. Monitoring net MRR growth is essential to ensure that expansion revenue from existing customers offsets any losses from churn [12]. With annual churn rates for established SaaS businesses typically falling between 5% and 7% [8], focusing on expansion opportunities can lead to net negative churn – a strong indicator that attracts premium valuations.

2. Usage-Based and Consumption Pricing

As of 2025, 60% of SaaS companies have adopted usage-based pricing models [13]. This strategy charges customers based on their actual consumption – whether it’s API calls, tokens processed, or completed transactions – instead of a flat monthly fee. Notably, 80% of customers say this approach better aligns costs with the value they receive [15].

Revenue Predictability (MRR/ARR Potential)

Revenue in pure usage-based models can fluctuate with customer activity, making it harder to predict. To address this, many startups are now opting for hybrid pricing models. These combine a recurring base fee with metered usage, ensuring a stable ARR while capturing additional revenue as usage grows [15][16][17]. Between 2020 and 2022, the number of companies using some form of usage-based pricing jumped from 9% to 26% [15]. By directly linking costs to consumption, this approach offers startups a scalable way to grow revenue while managing expenses efficiently.

Gross Margin Profile (AI-First vs. Classic SaaS)

For AI-first startups, usage-based pricing plays a key role in protecting gross margins from volatile computing costs. Unlike traditional SaaS platforms with minimal ongoing expenses, AI-first businesses face continuous costs like GPU usage, token processing, and model retraining [15][16]. For example, Anthropic‘s Claude API charges $3 per 1 million input tokens and $15 per 1 million output tokens, ensuring that heavy users pay in proportion to their consumption [16]. This pricing model ties revenue directly to infrastructure costs, helping maintain margins as the business scales [16].

"CFOs want evidence that every computing dollar returns measurable revenue. That’s why usage-based and outcome-based structures dominate current fundraising decks." – Orb [16]

Upsell and Expansion Potential

One of the standout benefits of usage-based pricing is its ability to drive higher Net Revenue Retention (NRR). Revenue naturally grows as customers increase their usage, minimizing the need for manual upsell efforts [17][18]. SaaS companies with over $200 million in ARR attribute about 65% of their growth to customer expansion, a trend heavily supported by usage-based models [18]. To prevent issues like bill shock or churn, startups are encouraged to implement tools like real-time usage dashboards and automated notifications when thresholds are reached [15][17].

Choosing the right value metric is also critical – one that aligns closely with the customer’s perceived value. For instance, charging based on queries processed rather than contacts stored ensures fairness as usage scales [17]. A study of Fortune 500 companies revealed that a 5% price increase through optimized value metrics could boost operating profits by 22% [13]. These pricing strategies not only enhance revenue but also pave the way for further innovation in SaaS business models.

3. Product-Led Freemium to Paid Conversion

Freemium isn’t a revenue model – it’s a strategy to bring in users while keeping acquisition costs low and your sales funnel active [19]. Think of your free tier as a magnet for high-quality leads. Take Mailchimp, for example: their "free forever" plan for users with fewer than 500 subscribers led to a 500% jump in signups, growing their user base from 85,000 to 450,000 [22]. This approach not only slashes acquisition costs but also sets the stage for smoother transitions to paid plans.

CAC Payback and Sales Complexity

Freemium companies benefit from 50% lower customer acquisition costs (CAC) compared to traditional paid models and boast nearly double the Net Promoter Scores of their non-freemium competitors [19]. While acquisition costs for general B2B and B2C businesses have surged by 50% in recent years, freemium startups have only seen a 25–30% rise [19]. As Zoom CEO Eric Yuan succinctly puts it, “It’s hard to tell customers, ‘You’ve got to try Zoom,’ without a freemium product” [22]. The freemium model thrives on strong product analytics to track and optimize conversions, making it a cost-effective way to scale.

Revenue Predictability (MRR/ARR Potential)

Freemium’s success hinges on solid unit economics. Patrick Campbell, Founder of ProfitWell, explains it best: “Freemium is a scalpel, not a sledgehammer. The most effective freemium plans come from companies that understand their unit economics after a few years in the market” [19]. Conversion rates typically hover around 1%, but the most successful companies aim for rates between 2% and 5% [21]. On top of that, the willingness to pay for entry-level paid tiers has skyrocketed – from $150 five years ago to nearly $1,000 today [19]. This shift drives significantly higher monthly recurring revenue (MRR) per converted user, making freemium a scalable and profitable strategy when executed thoughtfully.

Upsell and Expansion Potential

Freemium companies enjoy 15% higher net revenue retention, thanks to built-in opportunities for upselling and expansion [19]. The key is striking a balance: offer enough value in the free tier to attract users, but keep premium features behind a paywall [4]. Dropbox nailed this approach by offering 2GB of free storage, then converting users as their storage needs grew [4]. To maintain healthy margins, automate support for free users while reserving personalized, high-touch service for paying customers [4]. This tiered strategy keeps costs under control while maximizing the lifetime value of paying customers, ensuring recurring revenue stays strong and predictable.

4. Tiered Enterprise Licensing and Value-Based Pricing

Tiered enterprise licensing builds on subscription and usage-based models, offering a more customized pricing approach for larger clients. This strategy adjusts fees based on the value delivered, such as revenue growth, cost savings, or problem resolution [23]. It’s particularly effective for startups working with mid-to-large businesses that need predictable budgets and clear upgrade options. Beyond stabilizing revenue, this model also creates opportunities for strategic upselling.

Revenue Predictability (MRR/ARR Potential)

This approach ensures steady revenue through fixed monthly or annual fees [23]. Unlike usage-based models, which can fluctuate depending on customer activity, tiered subscriptions provide a reliable foundation for forecasting growth and managing resources like staffing. By focusing on stable fees and minimizing churn, businesses can secure consistent enterprise revenue. Metrics like Average Revenue Per User (ARPU) and the LTV-to-CAC ratio help ensure customers are aligned with the appropriate tier.

Gross Margin Profile (AI-First vs. Classic SaaS)

Traditional SaaS companies often maintain gross margins of 70% to 90%, as the cost of serving additional customers is minimal [6]. However, AI-driven startups face higher infrastructure costs. For example, a customer engagement software vendor experienced fluctuating gross margins due to AI compute expenses [24]. Value-based pricing can mitigate this by tying fees to completed tasks rather than metrics like API calls or tokens [11][24]. This decoupling helps stabilize margins while aligning pricing with measurable outcomes.

CAC Payback and Sales Complexity

Enterprise deals demand higher upfront investment but yield long-term rewards. Take Salesforce’s Agentforce platform: since October 2024, it has closed over 5,000 deals, including more than 3,000 paying customers, with pricing between $50 and $200 per agent per month [11]. While the sales cycle may be lengthy and involve multiple decision-makers, enterprise customers often become long-term partners. Using a "Good, Better, Best" pricing structure simplifies choices and encourages upgrades [23]. Additionally, customer interviews to assess willingness to pay, along with targeted promotions, can nudge clients toward higher-value tiers. These structured deals naturally set the stage for upselling and future growth.

Upsell and Expansion Potential

Tiered licensing is built for growth. As customers expand, they often hit limits – such as user seats, storage, or API usage – that prompt upgrades to higher tiers [25]. A notable example is Microsoft’s 365 Copilot add-on, introduced at $30 per user per month. By January 2025, this strategy added $13 billion in annualized AI revenue, leveraging its existing base of 345 million subscribers [11]. Similarly, AdVon Commerce implemented an outcome-based pricing model for a sporting goods retailer in October 2025, processing a 93,673-product catalog in under 30 days and generating a $17 million revenue boost within 60 days [11]. Structuring fees as a percentage of measurable revenue increases demonstrates how value-based pricing can drive expansion while aligning directly with business outcomes. This method not only supports customer growth but also optimizes revenue potential over time.

5. Transaction, Marketplace, and Take Rate Models

By 2026, startups are increasingly turning to transaction and marketplace models to diversify their revenue streams, adding to the other strategies outlined earlier. These models generate income by charging either a fixed fee or a percentage of each transaction – commonly referred to as the "take rate." For instance, PayPal applies both a percentage fee and a flat charge, while Fiverr collects a 20% commission on every completed project[4][28]. However, these models come with their own set of revenue challenges, which we’ll explore further.

Revenue Predictability (MRR/ARR Potential)

Predictability is a recurring issue for transaction-based models, as revenues can fluctuate significantly with changes in transaction volumes from month to month[4]. To combat this, many startups are incorporating subscription features alongside transaction fees. This hybrid approach, seen in platforms like Spotify and Dollar Shave Club, helps stabilize cash flow and improve revenue forecasting by leveraging historical data[9]. Consistently building a loyal, active audience is also critical for maintaining steady monthly revenue[9].

Gross Margin Profile (AI-First vs. Classic SaaS)

Marketplace models often achieve moderate margins by avoiding inventory-related costs[9]. That said, the profit margin heavily depends on the take rate after deducting expenses like payment processing, platform maintenance, and dispute resolution[3][20]. AI-powered transaction platforms face additional challenges, particularly the high compute costs associated with running advanced algorithms. These costs can be managed by implementing usage caps or outcome-based pricing models[7][27]. Unlike traditional SaaS, which typically boasts gross margins of 70% to 85%[8], transaction-driven businesses often see lower margins but greater scalability. For example, dropshipping businesses generally operate with margins between 10% and 30%[6].

CAC Payback and Sales Complexity

One advantage of transaction-based models is their relatively simple sales process compared to enterprise software platforms[9]. With no upfront costs for users, these models lower the barrier to entry, enabling rapid scaling once a cost-effective acquisition channel is established. Additionally, with 36% of U.S. workers now part of the gig economy[1], marketplace platforms have access to a large and consistent user base. The primary challenge lies in maintaining customer acquisition and retention to ensure repeat transactions over time[9].

Upsell and Expansion Potential

Transaction-based platforms can grow by increasing transaction frequency and offering premium services. Features like warehousing, fulfillment, or advanced seller analytics can raise the take rate per transaction[4]. Many platforms also introduce premium tiers that reduce transaction fees or unlock enhanced features, encouraging users to upgrade from basic to paid plans[26]. Additionally, cross-selling related products at checkout is a proven way to boost revenue[4]. By combining transaction fees with subscription elements, businesses can secure immediate income while positioning themselves for steady, long-term growth[9][28].

6. Hybrid Product Plus Services Bundles

The hybrid model blends software products with professional services, offering a flexible approach to meet evolving market needs. By 2026, startups are bundling software subscriptions with consulting, training, and implementation services. This combination not only ensures steady subscription revenue but also adds high-margin service income, creating a more resilient business structure.

Revenue Predictability (MRR/ARR Potential)

Hybrid bundles create a stable revenue foundation through subscriptions while leaving room for growth via service fees or usage-based pricing[11]. This approach addresses the expensive nature of AI adoption by incorporating essential change management services directly into the offering.

"For every $1 spent on AI model development, organizations should expect to spend $3 on change management costs."

McKinsey’s research highlights the significant investment required for training, integration, and adoption support[11]. By bundling these services, startups can reduce customer churn – a small 5% drop in churn can boost a company’s valuation by 25% to 95%[12]. Hybrid models that combine base subscriptions with usage-based pricing for advanced features illustrate how this revenue stability works in practice[11].

Gross Margin Profile (AI-First vs. Classic SaaS)

The profitability of hybrid models depends on the balance between high-margin software and lower-margin services[10]. This balance is particularly important for AI-focused solutions, where infrastructure costs can consume up to 75% of revenue at scale[11]. While traditional SaaS companies often achieve gross margins between 70% and 85%[8], AI-driven models face unique pressures. For instance, consulting or custom implementation services come with higher costs, which can dilute margins if not priced carefully[10].

Zendesk tackled this challenge in 2025 by introducing a hybrid pricing structure. They charged per seat for human users and added a separate fee per resolved ticket for AI agents, ensuring revenue aligned with the actual value of automation[11]. To protect margins, startups can implement usage caps or charge additional fees for high-demand AI features[27].

CAC Payback and Sales Complexity

Selling hybrid bundles often requires a more hands-on sales approach, especially for enterprise customers[3][29]. While this can lengthen sales cycles, it also allows for higher-value contracts. For example, Salesforce’s Agentforce platform, launched in October 2024, closed over 5,000 deals by charging per-agent licensing fees ranging from $50 to $200 per month, rather than traditional seat-based pricing[11].

Strategic use of services – such as installation, customization, and training – builds trust and strengthens brand awareness, making it easier to upsell later[29]. For early-stage startups, offering the core product at a lower price while charging for high-value services can help establish a loyal customer base[29]. This approach not only enhances customer relationships but also sets the stage for future upselling opportunities.

Upsell and Expansion Potential

Bundling products and services naturally creates opportunities for upselling as customers grow. Many businesses start with entry-level plans and gradually move to premium services or ongoing retainers. By presenting upgrades as logical next steps rather than aggressive sales pitches, startups can encourage broader adoption of their solutions[12].

The key to maximizing expansion lies in timing. After customers fully adopt the core product and see measurable success, they are more likely to invest in premium features or enterprise-level plans. Startups can also turn one-time service engagements into recurring monthly retainers for consulting or support, ensuring a steady revenue stream while deepening customer relationships[10][12].

7. Data, Intelligence, and Platform Access Fees

By 2026, startups are transitioning from simply selling raw data to monetizing AI-driven insights that predict outcomes and automate decisions. This shift is addressing a major challenge: much of the data organizations collect remains unstructured – think images, voice recordings, and documents. With the rise of generative AI, businesses can now clean, connect, and commercialize this untapped resource[7]. Leading organizations are already seeing the payoff, with 11% of their revenue coming from data monetization – a figure that’s five times higher than their less successful peers[7]. This move toward intelligence is transforming data into reliable, subscription-like revenue streams.

Revenue Predictability (MRR/ARR Potential)

Platform access fees are becoming a cornerstone of predictable recurring revenue, thanks to API subscriptions, tiered licensing, and usage-based pricing models. By 2026, 75% of businesses are expected to use generative AI to create synthetic customer data – a huge leap from less than 5% in 2023. This shift is unlocking new opportunities for data exchange and platform access[7].

Gross Margin Profile (AI-First vs. Classic SaaS)

Traditional SaaS companies typically enjoy gross margins between 70% and 85%[8]. However, AI-powered data businesses face higher capital demands. Training large models, ensuring real-time performance, and meeting low-latency requirements come with ongoing costs, particularly because these systems need continuous retraining[7]. A case in point: in March 2023, Bloomberg unveiled BloombergGPT, a 50-billion-parameter large language model trained on 40 years of proprietary financial data. This massive investment in infrastructure enables Bloomberg to process both dense structured data and vast amounts of unstructured text for financial intelligence[7].

"Intelligence is emerging as the new currency. Companies that continue to rely solely on selling raw data or building static analytics products risk being outpaced by AI-native challengers." – Ben Ellencweig, Senior Partner, McKinsey[7]

The challenge isn’t just the infrastructure costs; pricing these platforms requires clear demonstrations of ROI.

CAC Payback and Sales Complexity

Selling intelligence platforms often means tying pricing to measurable outcomes, such as qualified leads or prevented fraud[16]. Similar to usage-based and hybrid models, these platforms depend on proving tangible business value to justify their costs. Startups can simplify sales by tracking events at the point where value is created. This real-time tracking builds customer trust and lays the groundwork for expansion discussions. The secret to success lies in leveraging exclusive, high-quality datasets to avoid the pricing pressures common in raw data markets[7].

Upsell and Expansion Potential

Hybrid monetization models – blending a recurring base fee with metered usage – are gaining traction. These models allow startups to scale profitably as customer data consumption increases. For example, Notion AI transitioned from being an optional add-on to a core product feature by May 2025, reflecting this trend[16]. Combining recurring fees with usage-based pricing helps businesses optimize margins as they grow. This approach aligns with broader industry trends, as 52% of companies are adopting new monetization strategies to counter rising cloud and AI costs. Among software suppliers, 74% are now using usage-based pricing models[30]. Running historical usage simulations can help refine pricing tiers and reduce churn risk[16].

Comparing Profitability and Fit Across Models

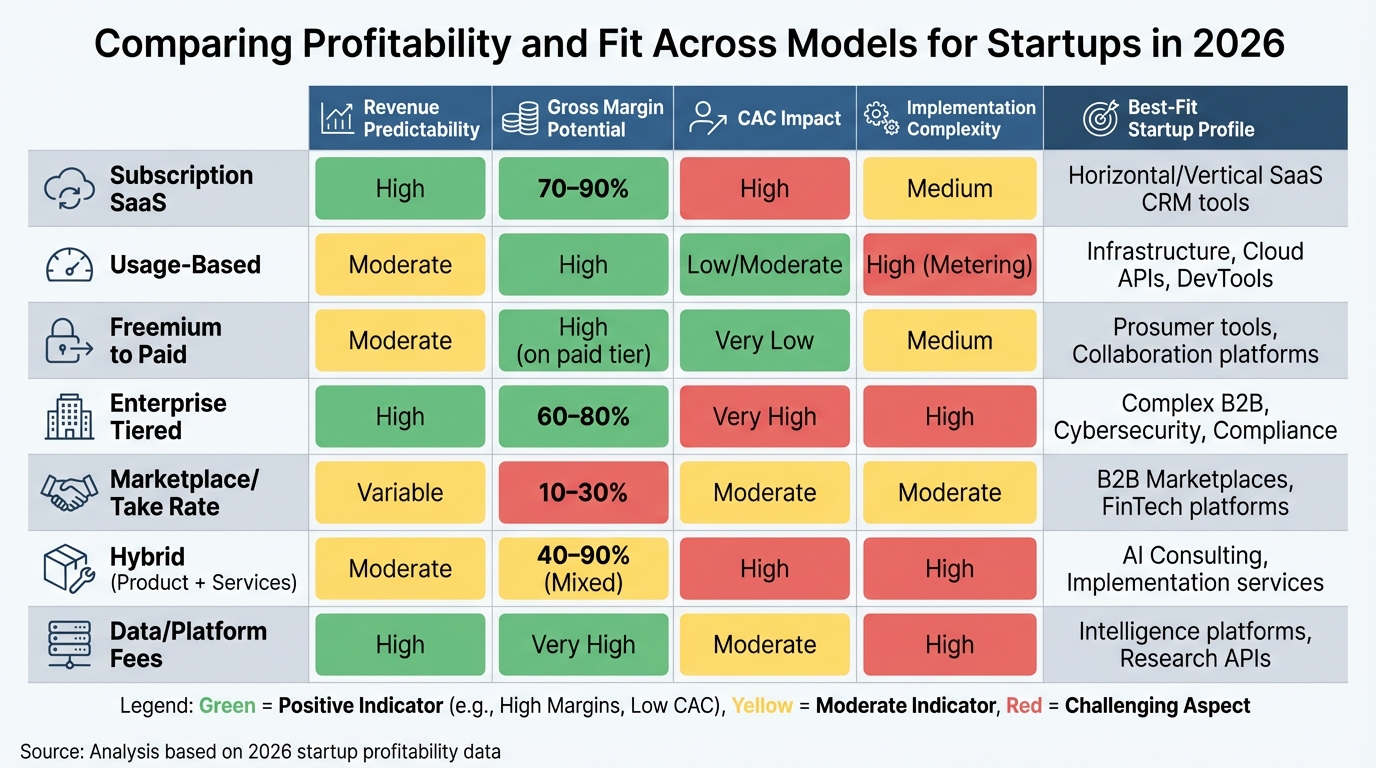

Startup Revenue Models 2026: Profitability Comparison Chart

Analyzing the various revenue models reveals a mix of strengths and trade-offs, each suited to different business needs. These models balance factors like revenue predictability, gross margins, and customer acquisition costs (CAC), shaping their overall fit for specific types of startups.

Subscription SaaS models stand out for their predictable revenue and impressive gross margins, typically ranging from 70% to 90%. However, these benefits come with challenges, including high CAC and the constant need to invest in customer retention efforts[6][9]. On the other hand, usage-based pricing lowers the initial barrier for customer acquisition, making CAC more manageable. Yet, it complicates revenue forecasting, as income fluctuates with customer usage patterns[9].

Enterprise licensing offers exceptional margins through long-term contracts, but the trade-off is a high-touch sales process, which drives CAC to its peak among all models[3]. Meanwhile, freemium strategies excel in acquiring users at a low cost through organic and viral growth. The challenge lies in converting free users to paying customers, which often requires significant user volume to reach profitability[3].

Transaction and marketplace models rely on scaling through volume and take rates, which typically range from 10% to 30%. However, these models face stiff competition and pricing pressures that can erode profitability[9]. Lastly, the hybrid product-plus-services approach blends high-margin software (70% to 90%) with steady service retainers, offering net margins between 20% and 40% – a combination that enhances revenue stability[6][9].

| Revenue Model | Revenue Predictability | Gross Margin Potential | CAC Impact | Implementation Complexity | Best-Fit Startup Profile |

|---|---|---|---|---|---|

| Subscription SaaS | High | 70–90% | High | Medium | Horizontal/Vertical SaaS, CRM tools |

| Usage-Based | Moderate | High | Low/Moderate | High (Metering) | Infrastructure, Cloud APIs, DevTools |

| Freemium to Paid | Moderate | High (on paid tier) | Very Low | Medium | Prosumer tools, Collaboration platforms |

| Enterprise Tiered | High | 60–80% | Very High | High | Complex B2B, Cybersecurity, Compliance |

| Marketplace/Take Rate | Variable | 10–30% | Moderate | Moderate | B2B Marketplaces, FinTech platforms |

| Hybrid (Product + Services) | Moderate | 40–90% (Mixed) | High | High | AI Consulting, Implementation services |

| Data/Platform Fees | High | Very High | Moderate | High | Intelligence platforms, Research APIs |

This breakdown highlights the potential of combining multiple revenue streams to target different customer segments. By strategically layering revenue models, businesses can increase customer lifetime value and reduce churn. Research shows that 90% of business model innovations come from recombining existing patterns[32]. For example, startups that pair a core SaaS subscription with additional features or professional services can maximize lifetime value while minimizing churn[32][5].

To succeed, it’s essential to establish a primary revenue stream first and then layer on complementary models. Offering a competitive core price while upselling premium features or services works particularly well for power users who need advanced capabilities[32].

The subscription economy is expanding at an annual rate of 14%, and by 2026, over 70% of U.S. small businesses plan to adopt AI technologies[31]. This trend opens doors for startups to bundle AI-powered tools with outcome-focused consulting, combining predictable recurring revenue with performance-based upsells. The most resilient startups will be those that use a layered approach: acquiring users through freemium models, ensuring steady income with tiered subscriptions, and capturing high-value customers with premium services. This strategy not only meets immediate revenue goals but also creates a competitive edge in a rapidly evolving market.

Conclusion

Choosing the right revenue model in 2026 requires careful alignment with your product’s stage, target audience, and growth objectives. As Rami Essaid, VP of Product Management at Antler, puts it:

"Defining your revenue model is one of the most important decisions for startup founders. Your revenue model sets up how you will operate your business, from attracting leads to sales and operations." [10]

The most successful startups tailor their revenue strategies to their current phase of development. Early-stage startups often benefit from transactional or freemium models to generate initial cash flow and gather valuable user feedback. Once product–market fit is established, transitioning to subscription or usage-based models can provide the predictability needed for scalable growth. For mature products targeting enterprise clients, tiered licensing or hybrid bundles can help maximize customer lifetime value [8]. This flexibility ensures your business can adapt as the market landscape changes.

Understanding market dynamics is equally important. With the AI SaaS market projected to hit $775.44 billion by 2031 and 75% of SaaS companies automating core processes with AI, startups that integrate AI tools with outcome-based pricing models are poised to stand out. Before committing significant resources, test your approach with real customers – conducting at least 50 structured interviews can provide critical insights [2].

To help navigate these complexities, Data-Mania‘s Fractional CMO services offer tailored strategies to optimize revenue models, track essential metrics, and support sustainable growth for B2B SaaS, marketplaces, and other tech startups. Strategic clarity and well-executed plans are key to ensuring your revenue model fuels long-term success.

Treat your revenue model as a living strategy that evolves with market feedback. Start with simplicity, validate your approach rigorously, and scale with intention.

FAQs

How are AI startups managing high infrastructure costs in 2026?

AI startups in 2026 are finding creative ways to manage rising infrastructure costs by blending smart pricing models with technical efficiency. Many are turning to usage-based or hybrid pricing structures, where customers pay based on metrics like API calls, data processed, or inferences performed. This approach ensures revenue grows in step with customer activity, helping to balance fluctuating cloud expenses. Hybrid models, such as combining a base subscription with usage-based extras, offer customers predictable pricing while spreading fixed costs across a broader user base.

On the technical side, startups are doubling down on cloud-cost optimization. They’re reserving instances for steady workloads, taking advantage of spot-market pricing, and using serverless functions to handle unpredictable demand spikes. Multi-cloud and hybrid-cloud strategies are also gaining traction as companies hunt for the most budget-friendly resources. To further cut costs, techniques like auto-scaling and model compression – including methods like quantization and pruning – are reducing GPU usage. By weaving these strategies together, AI startups are managing expenses without compromising on scalable, high-quality services.

What are the advantages of using multiple revenue models for startups?

Startups can benefit greatly from incorporating multiple revenue models, as it helps reduce reliance on a single income stream and brings more stability to their cash flow. Take a SaaS company, for example – it might pair recurring subscription fees with one-time consulting services. This setup ensures a consistent monthly income while also generating higher-margin revenue from individual projects.

Diversifying revenue streams can also expand a startup’s reach. Subscription plans might attract cost-conscious users, while licensing or transaction-based models could appeal to enterprise clients ready to invest in larger, one-time payments. By catering to a broader range of customers, startups can manage risks more effectively, address varied needs, and set the stage for steady, long-term growth.

Why is usage-based pricing becoming a popular choice for AI SaaS companies?

Usage-based pricing is gaining traction because it ties costs directly to how much a customer actually uses a service. This model offers clarity for customers – they’re charged only for what they use – while enabling companies to adjust revenue in real-time as customer activity increases.

For AI SaaS companies, this approach is especially effective. AI workloads often differ widely from one customer to another, and usage-based pricing makes it easier to handle these shifting demands. It also ensures customers feel the pricing reflects their actual results and needs.

Related Blog Posts

- 5 Ways AI Can Optimize Marketing ROI for your Tech Startup

- How Do Marketplaces Make Money & How to Monetize Yours

- Freemium vs Free Trial: PLG Strategy Guide

- AI Pricing Models Explained: Usage, Seats, Credits, and Outcome-Based Options