Mergers and acquisitions can transform a tech startup’s future by opening access to capital and new markets. While every deal has unique elements, the overall structure of a successful M&A timeline follows a predictable path. Understanding each stage helps founders prepare, avoid unnecessary delays, and maintain transparency.

Early Preparation and Internal Alignment

A strong M&A timeline begins long before outreach or negotiations. Startups need clear internal alignment on goals, such as gaining resources or securing a strategic partnership. Founders should review financials, technology assets, intellectual property, customer contracts, and employee agreements to ensure everything is documented and organized.

This preparation helps create a compelling profile for potential buyers or partners. It also ensures the startup can respond quickly when interested parties request information. Early clarity eliminates last-minute surprises and sets the tone for a more structured process.

Initial Outreach and Preliminary Conversations

The next stage involves connecting with potential acquirers. These conversations often begin informally through networking, investor introductions, or industry events. During this phase, both sides explore whether there is strategic alignment in terms of product fit, market expansion, or innovative capabilities.

If interest grows, the parties typically exchange a non-disclosure agreement so they can share sensitive details. The startup may provide high-level financial data, product roadmaps, and market growth indicators. These early discussions help determine whether a deeper exploration is worthwhile.

Term Sheet and Early Due Diligence

Once both sides agree to move forward, a term sheet outlines the initial expectations of the deal. This document covers price range, acquisition structure, timelines, and key obligations. While non-binding, it forms the framework for more detailed analysis.

Early due diligence begins shortly after. Acquirers examine finances, technology infrastructure, product stability, legal risks, and team structure. Tech startups should be prepared to share code documentation, security protocols, data compliance records, and intellectual property status. A well-organized company can accelerate this phase significantly.

Full Due Diligence and Regulatory Requirements

Full due diligence is often the most time-consuming stage. Acquirers look deeply into operational history, financial accuracy, potential liabilities, and long-term viability. For tech startups, this includes stress testing product scalability, evaluating engineering talent, and confirming customer retention metrics.

Regulatory requirements may also play a role, particularly if the deal involves public companies. Some organizations use tools such as the SEC filing calendar to ensure documentation and disclosures align with required reporting timelines. Completing this stage thoroughly builds trust and reduces risk for both parties.

Final Negotiations and Signing

After due diligence, both sides refine terms based on findings. This can involve adjustments to valuation, earn-out structures, leadership roles, or transition plans. Legal teams prepare final agreements, ensuring all obligations and protections are clearly stated.

Once everything is reviewed and approved, both parties execute the agreement. Public announcements, internal communications, and stakeholder updates are usually coordinated to maintain clarity and avoid misinformation.

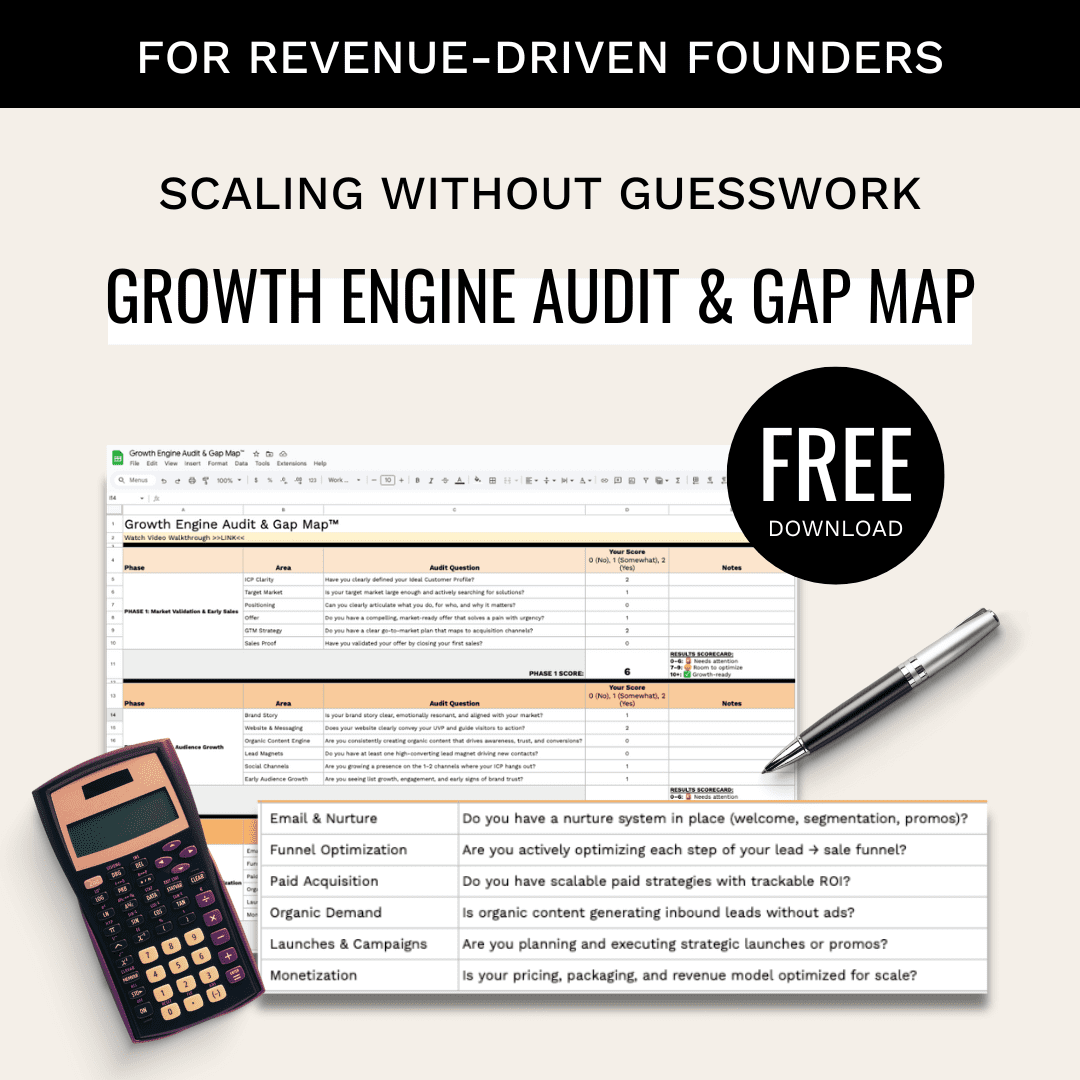

A successful M&A deal relies on preparation, transparency, and organized execution. By following a structured timeline, tech startups can move confidently through each phase and build partnerships that support long-term growth. Look over the infographic below to learn more.