Launching a tech startup is an exciting journey filled with ambition, innovation, and big dreams. However, even the most groundbreaking ideas need the right financial support to move forward. Without sufficient funding, scaling operations, hiring talent, and developing products can quickly become difficult. Choosing the right funding approach is one of the earliest and most important decisions a startup founder must make. Understanding the different funding options for tech startups can set the stage for long-term success.

Traditional and Modern Funding Options For Tech Startups

Many founders immediately think of venture capital when considering how to fund their startups. While venture capital can provide substantial resources and strategic advice, it often comes with expectations for rapid growth and equity stakes. This model works well for startups with high scalability and disruptive potential, but it is not the only route. Bank loans and small business lines of credit can also support startups that have a more steady growth plan, although they usually require a strong business plan and personal guarantees.

Angel investors offer another funding avenue. These are individuals who invest their own money into early-stage businesses they believe in. Often more flexible than venture capital firms, angel investors may be willing to back startups based on vision and potential rather than proven revenue. Crowdfunding has also gained popularity, allowing startups to raise small amounts of money from many people. A successful crowdfunding campaign can validate your product and build a loyal community even before launch.

Creative Financing for Greater Flexibility

Some startups prefer financing methods that avoid giving up equity. Bootstrapping, or self-funding, remains a powerful strategy for founders who want to maintain full control of their business. Although it can limit growth speed, it promotes discipline and sustainability. Another flexible option involves invoice factoring services, which allow startups to sell their accounts receivable at a discount to improve cash flow without taking on debt. This solution can be particularly helpful for tech startups working with large clients who have lengthy payment terms.

Grants and competitions provide non-dilutive funding opportunities. Winning a grant or an innovation competition can give a startup credibility, publicity, and essential financial support without the need to repay or share ownership. However, these opportunities are highly competitive and often require detailed applications and strong proof of concept.

Choosing the Best Fit for Your Vision

Each funding option carries its own advantages and risks. The best choice depends largely on your startup’s stage of development, revenue model, growth goals, and appetite for outside involvement. Some founders benefit from combining several funding sources to create a more stable financial foundation while preserving flexibility.

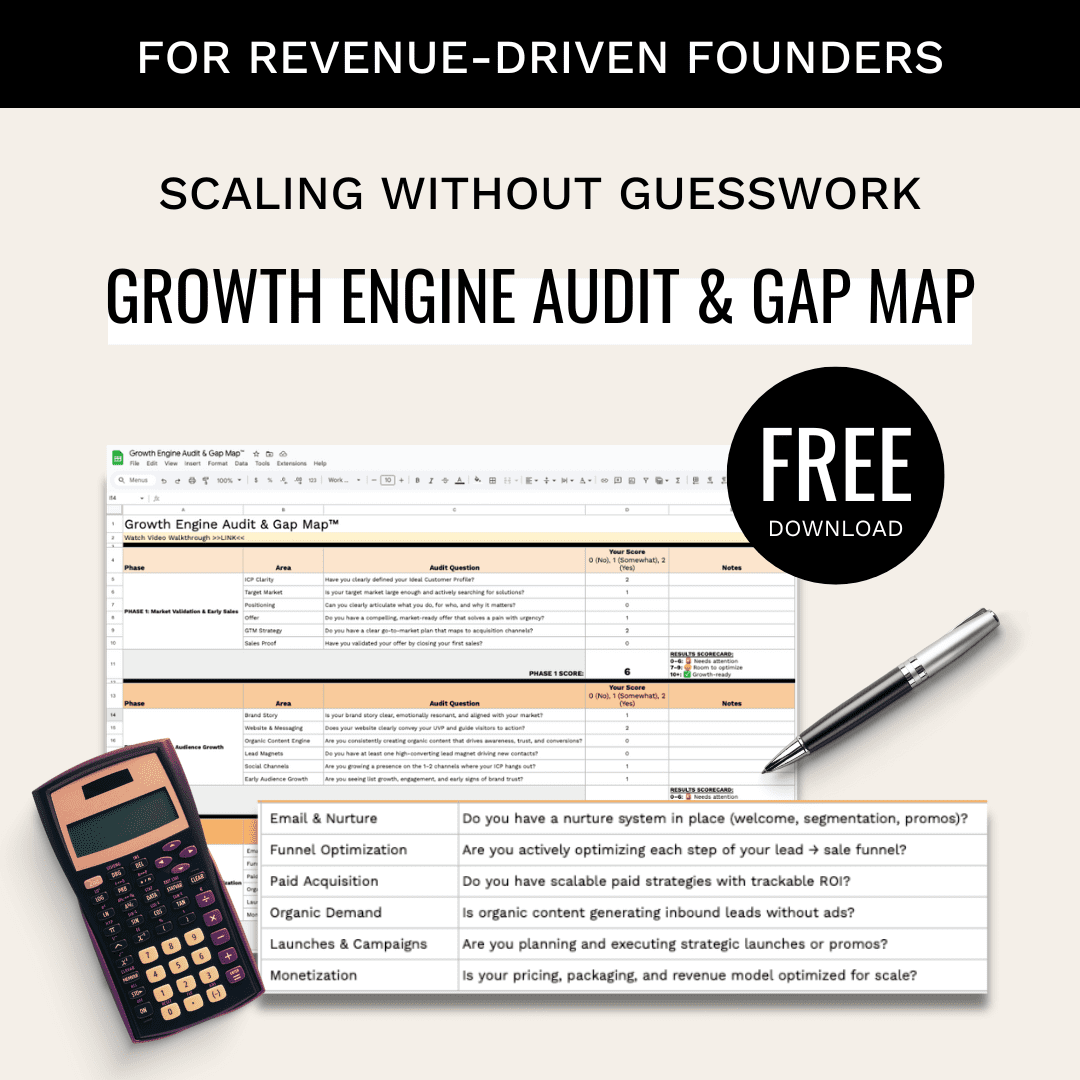

Securing the right funding is about more than just finding cash. It is about aligning your financial resources with your business strategy and long-term vision. Thoughtful selection among the many startup financing options can help your tech venture move from idea to reality with greater confidence and resilience. With careful planning and smart decision-making, the right financial partnership can open doors to growth, innovation, and lasting success. For more information, look over the accompanying infographic.