George Rekouts hit $2 million in revenue in under a year.

His first company, Mad Objective, was crushing it. IP-to-company mapping for visitor intelligence. Back when the category was still new, still exciting. He’d partnered with a distributor who had an established customer base. Sales came fast. Growth felt inevitable.

Then the distributor wanted to sell.

George had no choice but to exit. No independent brand. No direct sales motion. Complete dependency on the partner who’d gotten him to $2M so fast.

He watched the company grow to over $20 million post-acquisition.

Here’s what I keep thinking about: George didn’t fail. He succeeded fast, then got locked out of the upside because he’d outsourced the one function he thought he could afford to ignore: go-to-market.

Now he’s building DiscoLike, and this time he’s doing it differently. But the lesson he learned isn’t just about partnerships. It’s about a fundamental shift happening right now across B2B: engineering used to be the bottleneck. Now it’s go-to-market.![]()

And if you’re still relying on Apollo or LinkedIn data to fuel your outbound, you’re leaving money on the table in ways you probably don’t realize.

Apollo Isn’t Broken. But Here’s the Opportunity Loss

Let’s get something straight: Apollo works. Thousands of companies use it successfully. George uses it. I’m not here to trash a tool that clearly has product-market fit.

The real question is: what are you missing?

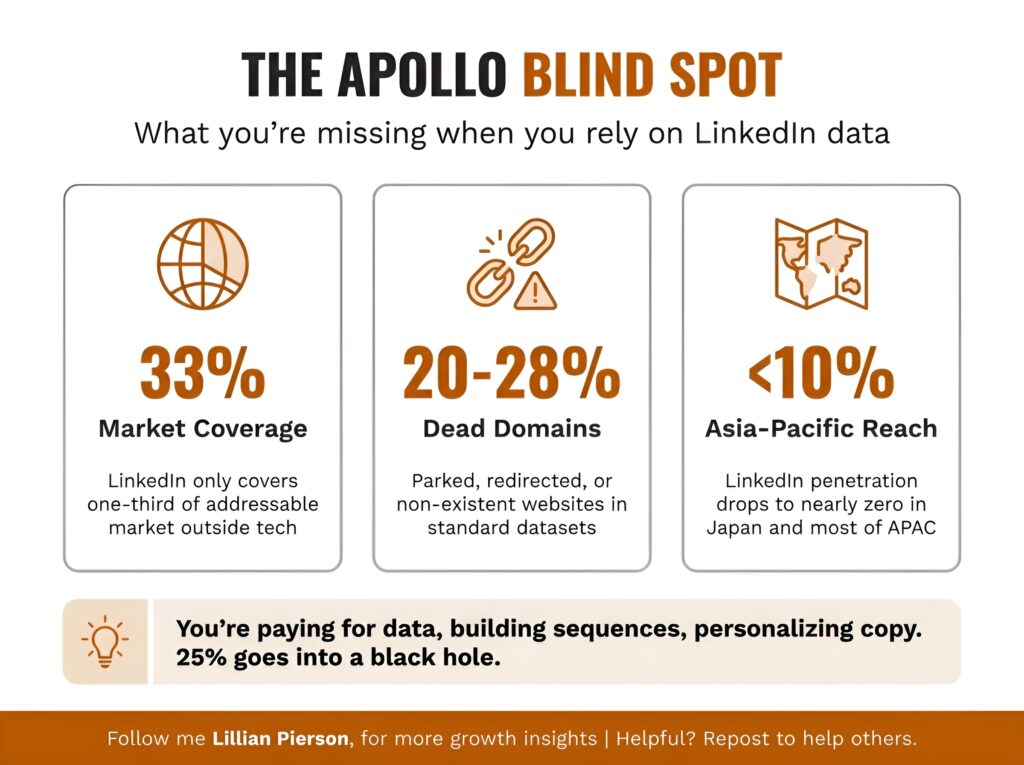

Here’s what might surprise you: LinkedIn covers about one-third of the addressable market.

If you’re selling dev tools to Series A startups in SF, NYC, or Austin? Great. Apollo is probably fine. Those founders live on LinkedIn. They update their profiles. They care.

But step outside that bubble and the coverage drops off a cliff.

Selling to legal? Construction? Medical devices? LinkedIn penetration in those verticals is dramatically lower. Lawyers and doctors don’t prioritize LinkedIn the way engineers and marketers do.

And internationally? Forget it.

LinkedIn company data by region:

- Germany and Norway: Weak

- France: Better

- Japan: Nearly non-existent

- Asia-Pacific overall: Tiny sliver

George puts it bluntly: “If you don’t target accounts outside of LinkedIn, you’re gonna be missing a lot.”

Then there’s the accuracy problem.

Here’s something that shocked me: the entire B2B data industry is powered by LinkedIn scrapes from essentially two top suppliers. That’s why every vendor claims “35 million companies” on their homepage. They’re all buying from the same source.

When George runs domain status checks on these datasets, he consistently finds 20-28% of domains are no good. Parked. Redirected to a new company name. Dead.

One-fourth of your list is wasted before you even hit send.

Think about that for a second. You’re paying for data, building sequences, personalizing copy. And 25% of it is going into a black hole.

In other words: Apollo isn’t broken. But if you’re outside the LinkedIn-heavy tech ecosystem, or if you’re trying to reach international markets, you’re operating with a massive blind spot and a significant data decay tax.

The Relevancy Trap: Why Keywords Can’t Capture Your ICP

Even if Apollo’s coverage was perfect, there’s a deeper problem. Keyword-based search forces you into spray-and-pray.

Let me show you what I mean.

Say you’re selling to medical device companies. Is that “healthcare”? “Manufacturing”? “Software”? You’re stuck choosing a category that doesn’t actually capture what makes your ICP unique.

Here’s where it gets worse: A company making blood test equipment is radically different from a company building lung machines. Which is different from an EKG device manufacturer. But in a keyword-driven system, they’re all bucketed together.

You end up with two terrible options:

- Go too broad (search “manufacturing”) and drown in noise. CNC machining shops, packaging companies, industrial suppliers. None of whom care about your product.

- Go too narrow (hyper-specific keywords) and miss half your addressable market because you couldn’t predict every term your ICP might use.

George’s take: “You need a semantic layer for search. You need a model that understands the concept, not just keywords or rigid categories.”

Or put another way: Traditional search tools assume your ICP can be described with a few industry tags and keywords. But real buyer intent doesn’t work that way. You need something that understands what a company does, not just what box they checked on their LinkedIn profile.

How Disco Sees 680 Million Secure Websites (And Why It Wasn’t Possible 5 Years Ago)

Here’s where George’s story gets interesting.

Disco’s data advantage comes from something I’d never heard of in this context: SSL certificate infrastructure.

You know that little lock icon in your browser? The one that says a site is secure? That’s an SSL certificate. And to get one, you have to prove to a certificate authority that you own the domain. No faking it.

This is the same technology that protects your banking transactions and Bitcoin trades. It’s bulletproof.

Google forced everyone to switch to HTTPS over the past several years. If you don’t have SSL, browsers block your site with scary warnings. So nearly every commercial website globally had to get a certificate.

Here’s the hack: Disco partnered with certificate authorities. They help flag malicious domains and fraud. In exchange, they get a real-time feed of every secure website that goes live.

Within 10 minutes of a site launching, Disco sees it.

680 million secure websites. About 68 million of those are commercial sites (after an LLM classifier filters out blogs, personal sites, etc.).

Think about what this means: While Apollo is scraping LinkedIn profiles that might be months out of date, Disco is watching the entire internet in near-real-time through first-party infrastructure.

George told me this wouldn’t have been possible even five years ago. The HTTPS mandate created the conditions for this data advantage. It’s an infrastructure-level moat that’s incredibly hard to replicate.

The hard part is: This isn’t cheap. Disco’s hardware footprint (GPUs for LLM processing plus petabytes of storage) is much higher than most B2B SaaS startups. They underestimated the cost.

But the result is a dataset that’s fundamentally different from anything built on scraped LinkedIn and Google Maps data.

Why Disco Built a Custom LLM (And Why It’s Easier Than You Think)

When George mentioned “custom LLM,” I assumed he meant something on the scale of Bloomberg or OpenAI. Years of R&D, massive compute budgets, the whole thing.

Turns out, it’s not like that at all.

Here’s what most people get wrong about large language models: We think “LLM” means “ChatGPT.” We think it means chatbots.

But LLMs existed before ChatGPT, and they can do a lot more than generate text. Classification. Data extraction. And in Disco’s case: search.

Disco didn’t build a reasoning engine. They built a search engine.

Here’s how it works:

Step 1: Grab text from a website and convert it into embeddings (numerical representations of meaning).

Step 2: Run a similarity search across embeddings from your search query and 68 million business websites.

Step 3: Return top results before similarity drop, as the closest conceptual matches.

The difference between chat and search models:

- Chat models (like ChatGPT) use embeddings to predict the next token. They’re trained to generate text word by word.

- Search models (like Disco’s) compare embeddings. They’re trained to find similarity, not generate sentences.

Same foundational architecture (LLM embeddings). Different inference path.

George’s point: “Building embeddings isn’t hard. You can use existing models and apply additional transfer learning, in Disco’s case focusing on business-specific data. The trick is swapping inference from ‘next token prediction’ to ‘similarity matching.'”

What this unlocks: You can search by concept, not just keywords. You describe what you’re looking for in plain language. “Medical device companies specializing in diagnostic imaging for hospitals.” And the model understands the semantic intent, not just the literal words.

This is why keyword search breaks down and semantic search works.

The Clustering Reveal: Why You Don’t Know Your Best Customers

Here’s my favorite story from the conversation.

One of Disco’s clients sells VCR software for commercial video recording. Think hundreds of cameras, simultaneous multichannel recording. They had about 8,000 customers.

For years, they were convinced police stations were their number one customer. That’s where the memorable deals came from. That’s who they pitched to investors. That’s how they thought about their market.

George ran their customer list through Disco’s clustering model.

The results:

- Shopping malls

- Commercial parking lots

- Hospitals

- Warehousing and manufacturing

- Police stations

Police were a distant fifth.

The founders had no idea. They’d been operating on anecdotal evidence. Memorable sales conversations, not data. And with 8,000 accounts, there’s no way to manually cluster and spot the pattern.

Here’s what makes this possible: Disco uses a specialized clustering model (not ChatGPT, which George says chokes beyond about 50-100 companies). The model segments your customer list automatically, revealing which verticals actually drive revenue.

Once you know your top segments, you run similarity search for each one. Upload five example domains from your best segment, generate an ICP description, and Disco finds precise matches across its 68 million commercial sites in 48 languages

The workflow:

- Segment existing customers

- Discover hidden revenue drivers

- Run lookalike search per segment

- Export hyper-targeted prospect lists

This is the opposite of spray-and-pray. This is surgical.

Steal This: The One-Evening Validation Framework

George wanted to test whether open-source intelligence companies would buy Disco’s data as a side revenue stream.

Instead of spending weeks researching the market, he did this:

Evening 1:

- Used Disco to find 20 OSINT companies

- Messaged founders on LinkedIn with a simple pitch

- Got responses within minutes

That’s it. One evening. He validated (or invalidated) an entire vertical.

Here’s the framework George uses:

Step 1: Find 20 Hyper-Targeted Companies

Not 1,000. Not 500. Just 20 companies that perfectly match your ICP for a specific segment.

Step 2: Message Founders on LinkedIn

Use the 2-2-1 structure:

First 2 lines: Hook them. State the problem or opportunity.

Next 2 lines: Show how you’re different.

1 CTA: Low-friction value offer. No hard sell.

George’s example:

“You’re targeting one-third of your market with LinkedIn data. I can show you 60% more. Want me to prove it? No strings attached.”

Step 3: Measure Response

Out of 20 messages, George typically sees:

- 12 connections

- 6 responses

If your ICP is tight, the response rate is shocking. If you get silence, your targeting is off. Or the vertical doesn’t care about your problem. Either way, you know within hours, not months.

Step 4: Iterate or Pivot

If it resonates, go deeper. If not, test the next vertical tomorrow night.

George’s philosophy: “People overthink how easy this is. You have your offer. You find the companies. You ping the best 20. Done.”

The Bottleneck Just Flipped: Engineering to Go-To-Market

Here’s the shift George sees happening right now:

For 25-30 years, engineering was the bottleneck. Every other function (sales, marketing, ops) moved at the speed of the product team. You had to wait for engineers to build the thing before you could sell it.

AI changed that.

You can build a product in six months now. Wrap ChatGPT. Launch an MVP. Validate quickly. Maybe you swap in a custom model later, maybe you don’t. The point is: the product isn’t the constraint anymore.

The new bottleneck is go-to-market. Reaching the right users. Testing messaging. Finding your best segments. Distribution.

Think you need the perfect product before reaching out? Here’s why that’s costing you months of learning.

George’s advice to founders: “Start reaching out as soon as you can. Literally, don’t be shy. Think of the vertical, build the list, test it. You can validate a vertical in one evening.”

The hard part is: Most technical founders resist this (myself included, as a licensed professional engineer). We want the product to be perfect first. We want elegant architecture. We want to solve hard technical problems.

But if no one knows you exist, none of that matters.

Or put another way: Stop perfecting your product. Start testing your market.

The List-First Cold Outreach Formula

I’ll be honest. I’ve always been skeptical of cold outreach. I’ve built my career on inbound. I get hundreds of cold emails a week, and most of them annoy me.

But George’s framework made me rethink this.

His thesis: List quality matters 10x more than copy quality. Your list is the message

If you’re reaching the right people who have a real problem you can solve, even mediocre copy works. They’ll respond because the timing is right, the fit is obvious, and you’re offering something they actually need.

Here’s the structure George uses:

First 2 Lines: Hook Them

People won’t read beyond two lines unless you nail the hook. State the problem or opportunity clearly. No fluff.

Example: “Most dev tool companies are only reaching one-third of their addressable market because they rely on LinkedIn data.”

Next 2 Lines: Show Differentiation

How are you different? What can you do that they can’t get elsewhere?

Example: “We use SSL certificate infrastructure to see 68 million business websites in real-time. Including the two-thirds LinkedIn doesn’t cover.”

CTA: Low-Friction Value Offer

Don’t go for the hard sell. Offer value with no strings attached.

George’s go-to: “How about we test it and you see if you find more data with us? No commitment, just proof.”

The psychology here: You’re not asking them to buy. You’re offering to prove your claim. If your targeting is right, they’ll want to see the proof.

George’s hit rate: 20 messages → 12 connections → 6 responses (when ICP targeting is tight).

The insight I’m taking away: I’ve been so focused on perfecting inbound funnels that I dismissed outbound entirely. But if you’re validating messaging or testing new segments, George’s framework is faster and cheaper than running ads or paying for focus groups.

You just need the discipline to keep your list hyper-targeted.

What George Would Tell His 2015 Self

We circled back to the Mad Objective story at the end of our conversation.

I asked George what he’d tell his 2015 self. The version of him who was about to partner with that distributor and race to $2 million in under a year.

His answer: “Own your go-to-market. Don’t outsource it, no matter how tempting the short-term speed is.”

The distributor gave him instant access to customers. It felt like a shortcut. And it was. Until it wasn’t. When they sold, George had no leverage. No independent brand. No way to keep building.

He left money on the table. A lot of it.

George’s other lesson on partnerships: If you have first-party data, sell it yourself. Don’t give it to someone else to monetize while they collect the margin. If you need data, buy it. Don’t build in-house unless it’s your core differentiator. Focus on what makes you unique.

Here’s the broader lesson: The bottleneck shifted from engineering to go-to-market, but most founders are still operating like it’s 2015. They’re perfecting the product, optimizing the architecture, waiting for the right moment to “do marketing.”

But the founders who win now are the ones who embrace distribution from day one. Who test verticals in an evening. Who build their own customer relationships instead of depending on partners.

George’s second time around, he’s doing it differently. Product-led growth. Direct user acquisition. No dependencies. And a dataset that’s genuinely differentiated because it’s built on first-party infrastructure, not scraped LinkedIn profiles.

P.S. The Question I Didn’t Ask

After we stopped recording, I kept thinking about something George said: “You can test a vertical in one evening.”

I’ve spent years building inbound funnels. SEO. Content. Paid ads. All of it designed to attract the right people over time. And it works. But it’s slow.

What if I’m overthinking it?

What if the fastest way to validate messaging isn’t running A/B tests on landing pages? What if it’s just finding 20 people in my ICP and asking them directly?

Last Tuesday I pulled a list of 18 companies in a vertical I’ve been curious about. Messaged their founders. Got 7 replies in 36 hours. Three wanted to see demos. Two became paying customers within a week.

Here’s what I learned: I’ve been hiding behind “perfect product development” when what I really needed was just to talk to people.

If you want to try George’s framework, here’s where to start:

- Use DiscoLike (or any tool that lets you build hyper-targeted lists) to find 20 perfect-fit companies

- Message their founders on LinkedIn with the 2-2-1 structure

- Measure response rate within 48 hours

If you get crickets, your targeting or messaging is off. If you get replies, you’ve validated something real.

The hard part is: You have to be willing to hear “no” quickly instead of hiding behind perfect product development.

But that’s the shift. That’s the new bottleneck.

Want to see how Disco works? They have pre-configured sample queries on their site so you can test the output before committing. No free trial anymore (George got burned by people mining their GPUs), but you can browse sample data to see if it’s a fit.

Check out DiscoLike here | Connect with George on LinkedIn