The early days of a startup are often marked by energy, innovation, and optimism. Founders hustle to turn ideas into prototypes then into real products with real users, without fully understanding the nuances of the startup funding lifecycle. But once the foundation is set and traction is visible, the next phase begins. Scaling a startup requires more than vision. It requires capital, and finding the right kind at the right time can be harder than expected.

Gaps in the Startup Funding Lifecycle

The startup funding lifecycle typically begins with seed rounds or early angel investments, which often depend on the founder’s personal network. Once a business gains momentum, Series A and beyond provide the fuel for hiring, product development, and market expansion. However, the gap between these stages is where many startups stall. A business may be too advanced for pre-seed investors but still considered too risky or small for institutional funds. This funding no-man’s-land can delay key decisions or force founders to dilute equity more than they anticipated.

Timing plays a significant role. Raising capital too early can create pressure to scale before product-market fit is established. Waiting too long may cause competitors to move faster or capital reserves to run dry. Investors evaluate not only performance but also the clarity of a company’s path forward. A strong pitch deck without clear financial projections or a reliable customer acquisition strategy often gets passed over.

Investor Expectations and the Proof Problem

As companies move through the startup funding lifecycle, investor expectations rise steeply. Early believers may back a concept. Later-stage investors expect evidence. This includes detailed KPIs, churn metrics, revenue growth, and retention rates. In sectors like fintech or healthcare, additional regulatory hurdles raise the bar even further. Founders must shift from storytelling to financial rigor.

Another common issue is that startups may misjudge their valuation. Founders influenced by early enthusiasm may pitch inflated numbers, which can scare off serious investors or set the business up for failure in the next round. A bloated valuation without the operational performance to match leads to down rounds, morale issues, and reputational damage in future negotiations.

Strategic Misalignment and Missed Opportunities

Funding can also go sideways when there is a mismatch between a company’s goals and an investor’s expectations. A startup focused on long-term sustainability may clash with investors looking for aggressive growth at all costs. In areas like clean tech investing, founders may find better alignment with mission-driven funds that understand longer development cycles and complex go-to-market timelines.

Startups that succeed in scaling often combine financial discipline with strategic flexibility. They treat fundraising as part of their business model rather than a separate task. This means staying engaged with investors even when not actively raising and constantly refining both short- and long-term plans.

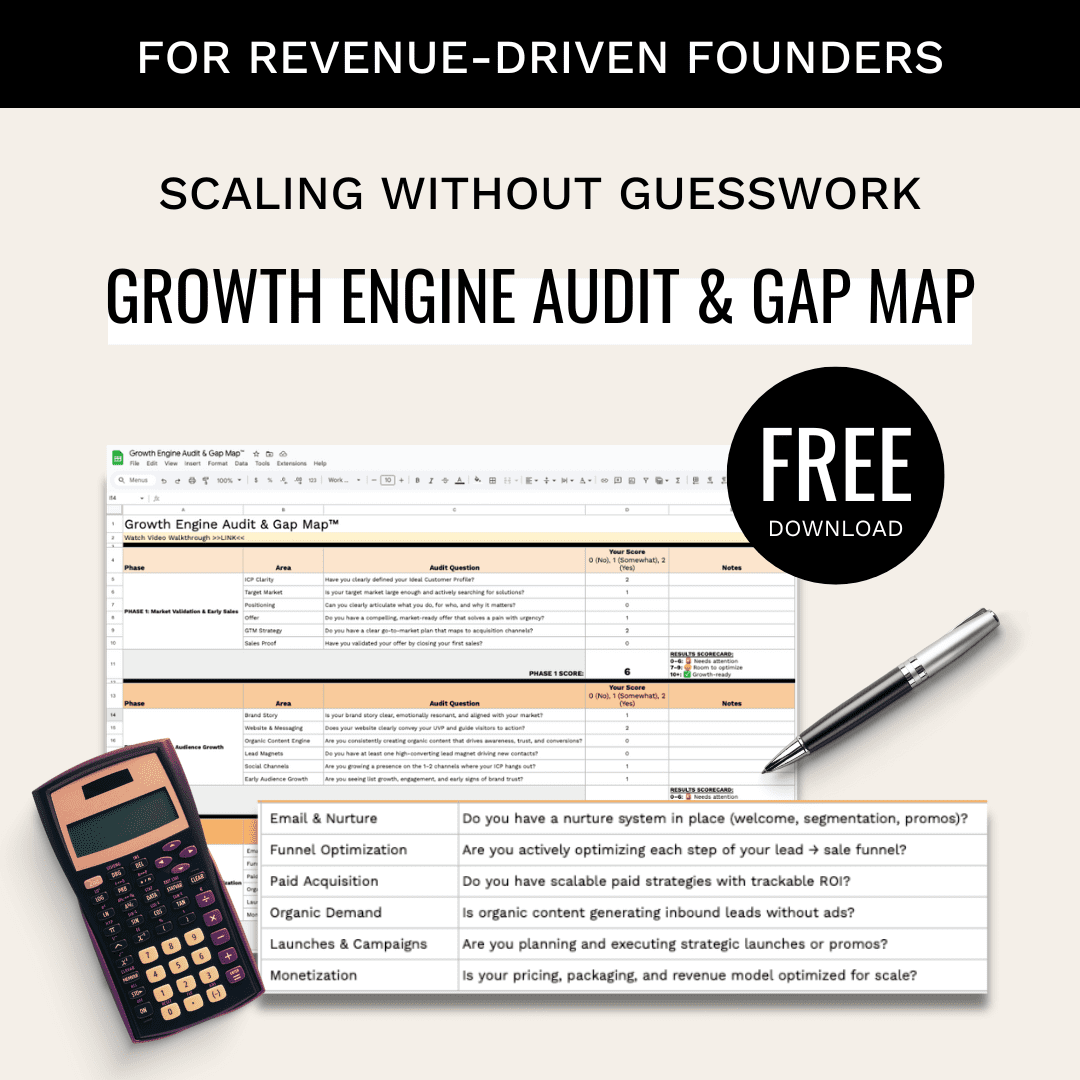

Scaling a startup is rarely a straight line. There are pivot points, pauses, and recalibrations. However, startups that keep an eye on their metrics, refine their funding strategy, and maintain honest conversations with potential investors are better prepared for the road ahead. To learn more, look over the accompanying resource below.