Dynamic pricing is reshaping how B2B tech companies set prices, enabling them to adjust rates based on real-time factors like demand, competitor actions, and customer behavior. This approach helps businesses improve margins, win rates, and customer satisfaction. Here’s the gist:

- What is Dynamic Pricing? A flexible pricing strategy that adjusts rates using data-driven insights. Examples include cloud providers modifying prices based on server load or software vendors tailoring fees to feature usage.

- Why Use It? Companies benefit from personalized pricing, quicker responses to market changes, and better inventory management.

- Challenges: Long-term contracts, complex discount structures, and technical integration can complicate implementation.

- Key Strategies:

- Rule-based Pricing: Simple "if-then" rules (e.g., markup over costs).

- Value-based Pricing: Pricing based on perceived customer value.

- Customer Segment Pricing: Adjusting prices for different customer groups.

- Technology’s Role: AI and machine learning enable real-time adjustments, demand forecasting, and personalized pricing.

- Competitor Monitoring: Tools like web scraping and software help track competitor rates and refine strategies.

Dynamic pricing requires robust data, seamless system integration, and ongoing monitoring to stay effective. Companies leveraging this approach often see revenue growth of 2–5% and margin improvements of 5–10%. If you’re not using dynamic pricing yet, you’re likely leaving money on the table.

How to Deliver Real Time Market Pricing in a Dynamic B2B Environment

Main Dynamic Pricing Strategies for B2B Tech

B2B tech companies use tailored pricing strategies to align with market demands and customer profiles. These approaches help businesses stay competitive and adapt to ever-changing market conditions.

Rule-based Pricing

Rule-based pricing relies on straightforward "if-then" rules to adjust prices based on predefined factors like competitor pricing or cost-plus calculations. For instance, a company might set prices to maintain a 15% markup over costs or to undercut competitors by 5%. This method’s simplicity makes it easy to implement, but it often falls short in capturing what customers are truly willing to pay [6].

Value-based Pricing

Value-based pricing focuses on setting prices according to the value customers see in a product or service. This requires a deep understanding of how a solution benefits different buyers and detailed data collection to assess willingness to pay [5]. Research indicates that 28% of pricing professionals prefer value-based models for maximizing revenue [9].

"Competitive strategy is about being different. It means deliberately choosing a different set of activities to deliver a unique mix of value."

– Michael E. Porter [9]

Customer Segment Pricing

Customer segment pricing adjusts prices for different customer groups based on factors like company size, order volume, or lifecycle stage [7]. A great example is Tableau, which offers its full data visualization software package free to students while charging professionals up to $925 for complete access [7]. Success in this approach depends on precise segmentation, identifying variations in usage, budget, or strategic importance [11].

Summary of Key Strategies

Here’s a quick comparison of the main pricing strategies:

| Pricing Strategy | Primary Focus | Data Requirements | Best Use Case |

|---|---|---|---|

| Rule-based | Cost/Competitor-focused | Easily measurable parameters | Protecting margins during cost fluctuations |

| Value-based | Customer-focused | Extensive customer value data | High-value, differentiated solutions |

| Customer Segment | Group-focused | Segmentation and differentiation data | Serving diverse customer needs |

Practical Applications

Implementing these strategies requires careful attention to fairness and transparency. For example, a wholesale medical supply store on Shopify identified through firmographic segmentation that larger healthcare businesses faced challenges with cumbersome ordering processes. By analyzing behavioral data, they pinpointed problem areas and introduced a bulk order solution, streamlining the experience for that segment [10].

Most successful B2B tech companies combine multiple pricing approaches. A recent study revealed that 54% of manufacturers and distributors use price optimization strategies blending different methods. For instance:

- Cost-based pricing helps safeguard margins during supplier cost increases.

- Value-based pricing leverages customer-focused opportunities.

- Market-based pricing aids in capturing market share [9].

The best pricing strategy often depends on a company’s goals and market conditions. Rapidly growing businesses might prioritize market-based methods, while established firms could lean on value-based strategies to drive profitability. These approaches provide a foundation for integrating technology and data to refine dynamic pricing further.

Using Data and Technology for Dynamic Pricing

Today’s B2B tech companies are using advanced technology and analytics to fine-tune their pricing strategies in real time. By combining artificial intelligence (AI), machine learning, and integrated systems, businesses can make smarter pricing decisions that adapt to ever-changing market conditions. Let’s dive into how these tools – and the right data – are shaping dynamic pricing models.

Using AI and Machine Learning

AI and machine learning are reshaping the way B2B companies approach pricing. These technologies can process massive datasets, uncover patterns, and adjust prices in real time based on market trends, competitor actions, and customer behaviors [8].

Here’s the impact in numbers: companies using AI for pricing transformations succeed twice as often, with large enterprises (those earning $10 billion or more annually) seeing revenue gains of $100 million 70% more often than those not leveraging AI [14].

One of AI’s key strengths is demand forecasting. Machine learning algorithms can predict demand shifts and help businesses adjust their pricing strategies to maximize revenue. For instance, a metal packaging company improved its profit margins by 3% over two years using an advanced pricing management tool. Similarly, a logistics company anticipates a $100 million boost in annual sales by implementing an AI-powered product recommendation engine [13].

AI also enables personalized pricing. Instead of relying on one-size-fits-all pricing rules, machine learning tools can analyze customer data, purchase histories, and behavioral trends to determine the best price for each customer segment – or even individual accounts [8]. By automating these processes, companies free up their teams to focus on higher-level strategies like identifying market opportunities and building stronger customer relationships [12].

Connecting Dynamic Pricing with Existing Systems

For dynamic pricing to work seamlessly, it must integrate with a company’s existing systems. Connecting tools like CRM, ERP, and eCommerce platforms ensures that pricing updates happen smoothly and efficiently [8].

CRM integration, for example, allows businesses to quickly respond to changes in supply and demand while keeping a clear view of customer relationships and the sales pipeline [8]. ERP systems, on the other hand, help ensure pricing decisions account for inventory levels, cost changes, and operational constraints.

Take this example: a logistics provider improved its conversion rate from 1.8% to 3.0% – a change that could generate $120 million in additional annual revenue – by integrating AI-driven voice analysis into its systems [13]. When customer data, product details, and pricing rules align across platforms, companies avoid costly errors and maintain customer trust.

Important Data Sources for Pricing Decisions

Dynamic pricing thrives on quality data from a variety of sources – not just tracking competitors [12]. Here are three key types of data businesses rely on:

- Customer Behavior Data: This includes insights from website analytics, purchase histories, responses to past price changes, and interactions with sales teams. Such data helps companies understand how different customer segments react to pricing shifts and identify areas for improvement.

- Market Trend Data: Broader industry trends – like economic indicators, seasonal patterns, and regulatory updates – can influence demand and competitive positioning. Staying ahead of these trends is essential for pricing strategies.

- Inventory and Operational Data: Pricing decisions must align with a company’s capacity and cost structures. For instance, a telecom provider expects a 5–15% increase in sales by using generative AI for account planning, which factors operational data into pricing recommendations [13].

The value of dynamic pricing is clear. In 2023, the market for dynamic pricing was worth $1.8 billion, with projections estimating it will grow to $6.5 billion by 2033 [15]. Companies that invest in strong data management systems can unlock margin boosts of 4–8% and achieve revenue growth exceeding 5% [8].

Competitor Monitoring and Benchmarking for B2B Pricing

Keeping tabs on competitor pricing is a cornerstone of dynamic pricing in the B2B tech space. Without a clear understanding of how your competitors price their offerings, you risk losing deals or leaving money on the table. This section ties competitor insights to the broader strategy of dynamic pricing, building on earlier discussions about data and technology integration.

How to Monitor Competitor Prices

There are three main ways to track competitor prices: manual research, web scraping, and specialized software tools. Each method comes with its own set of benefits and challenges, impacting factors like cost, efficiency, and accuracy.

Manual research is the old-school approach. It involves having your team visit competitor websites, review public price lists, or gather intel from sales teams who deal with prospects in competitive scenarios. This method works well for smaller companies or niche markets where only a handful of competitors need to be tracked. But it’s time-intensive, prone to human error, and hard to scale as your business grows.

Web scraping takes automation to the next level by using software to extract pricing data directly from competitor websites. It’s a more efficient way to handle large datasets and allows for consistent monitoring. However, many websites now use anti-scraping measures, and some explicitly prohibit it in their terms of service. Plus, maintaining and updating scraping tools as websites change requires technical expertise.

Specialized software tools are the go-to option for larger B2B tech firms. These tools offer real-time monitoring, built-in analytics, and seamless integration with systems like CRM or ERP platforms. Features like automated alerts for price changes and AI-driven insights make it easier to predict competitor strategies or track pricing variations across regions or customer segments. That said, these tools often come with subscription fees and require a more complex setup.

| Monitoring Method | Best For | Key Advantages | Main Limitations |

|---|---|---|---|

| Manual Research | Small firms, niche markets | Low cost, adaptable | Labor-intensive, hard to scale |

| Web Scraping | Mid-size firms, broad portfolios | Automates data collection, handles volume | Legal/technical challenges, needs maintenance |

| Software Tools | Large firms, real-time needs | Real-time updates, analytics, integrations | High cost, complex setup |

How to Analyze Competitor Pricing Data

Raw pricing data from competitors is just the starting point. In B2B transactions, pricing often includes variables like volume discounts, service tiers, and different terms, making direct comparisons tricky. To make the data usable, it needs to be normalized.

Start by converting all prices to a common currency like USD and standardizing units (e.g., per user/month). Don’t forget to account for hidden costs, such as implementation fees or ongoing support, that competitors might bundle differently.

Segmenting the data is where the real insights emerge. For example, geographic segmentation can reveal how competitors adjust prices for local market conditions. Statistical tools can help separate meaningful patterns from random fluctuations, identifying outliers or temporary promotions. Visualization tools are especially helpful for spotting trends like seasonal pricing shifts or gradual changes in market positioning.

Context is just as important as the numbers. A competitor’s price drop might signal a new product launch, financial struggles, or a strategy to grab market share. Understanding the "why" behind pricing changes allows you to respond strategically rather than reactively.

Benchmarking Best Practices

Once your data is standardized and segmented, the next step is effective benchmarking. This is where you measure your pricing against the most relevant competitors. In dynamic pricing, benchmarking is a natural extension of leveraging high-quality data.

Focus on competitors that target similar customer segments and offer comparable products or services. But don’t overlook new players or startups from adjacent markets – they can disrupt pricing norms with different cost structures or strategies.

Regional factors are critical for accurate benchmarking. Local market conditions, regulations, and operating costs can significantly impact pricing. Currency fluctuations also play a role, especially when dealing with international competitors.

Industry-specific factors matter too. For instance, a competitor might charge higher rates for healthcare clients due to stricter compliance requirements, while offering standard pricing for manufacturing clients. Segment-specific benchmarking ensures apples-to-apples comparisons.

Real-world examples highlight the importance of systematic competitor monitoring. In 2024, a defense supplier used dynamic pricing with integrated competitor tracking to respond more quickly to government RFQs. By monitoring competitor pricing and adjusting their quotes accordingly, they shortened internal review cycles and improved win rates without sacrificing compliance [2].

Another example comes from a chemicals distributor that linked its pricing engine to both commodity market indices and competitor prices. This dual approach allowed for automated price adjustments based on raw material costs while staying competitive. During volatile market conditions, this strategy helped maintain margins and kept sales teams aligned with market realities [2].

Regularly reassessing your competitor set is also essential. Markets evolve, new players emerge, and existing competitors change their strategies. Make it a habit to review and adjust your monitoring scope to ensure you’re tracking the right companies.

sbb-itb-e8c8399

How to Implement Dynamic Pricing in B2B Tech

Dynamic pricing in B2B tech involves three key phases: building the infrastructure, launching pricing models, and monitoring performance.

Setting Up Dynamic Pricing Infrastructure

The first step in implementing dynamic pricing is securing stakeholder alignment. Work with leadership to define clear objectives – whether it’s growing market share, boosting profits, or speeding up sales cycles. These goals will guide decisions about data, algorithms, and implementation.

Next, focus on data readiness. Dynamic pricing thrives on quality data, so gather historical sales records, market trends, competitor pricing, and customer behavior insights. Before using this data, clean it up to ensure accuracy and reliability in your pricing model.

Identify the key pricing factors that influence decisions. In B2B tech, these could include demand trends, competitor actions, seasonality, inventory levels, and customer segmentation. Other factors like contract duration, implementation complexity, and ongoing support requirements often play a major role in pricing strategies.

Your tools matter too. Decide between Excel-based models and specialized pricing software based on your business size and complexity. Excel works well for smaller companies with simple needs – it’s cost-effective but requires manual updates and has scalability limits. Larger organizations, however, may benefit from pricing software, which offers automation, real-time updates, and advanced analytics. Keep in mind that these tools come with higher costs and may require more training to implement.

| Approach | Best For | Key Benefits | Main Drawbacks |

|---|---|---|---|

| Excel Models | Small companies, simple pricing | Low cost, familiar interface | Manual updates, prone to errors |

| Pricing Software | Large firms, complex models | Automation, real-time updates | High cost, complex setup |

Finally, ensure your technology infrastructure integrates seamlessly with existing sales and CRM systems. This enables real-time price adjustments, allowing your pricing model to quickly implement changes across all customer touchpoints.

Once the infrastructure is ready, you can move on to piloting and launching your pricing model.

Launching Dynamic Pricing Models

Begin with a pilot program to test your model in a controlled environment. Choose a specific product line or customer segment to refine your approach without risking widespread disruption. During this phase, track metrics like revenue and margin changes, while gathering feedback from sales teams and customers.

Training your sales team is essential. They need to understand how the dynamic pricing model works and how to explain its value to customers. Training should cover both the technical aspects of the system and the strategic reasoning behind pricing changes, so sales representatives can confidently interpret and communicate price adjustments.

Develop a pricing formula that incorporates your key factors. Use techniques like A/B testing or simulations to refine the model based on early results. This allows you to optimize performance before rolling it out on a larger scale.

Tracking Success and Avoiding Common Mistakes

Once your pricing model is live, it’s critical to monitor its performance and make adjustments as needed. Track Key Performance Indicators (KPIs) such as net price realization, revenue growth, profit margins, sales volume changes, and customer retention rates. For many B2B companies, even a 1% improvement in average realized price can lead to an 8–11% increase in operating profit[4]. Companies often see margin improvements of 4–8% and revenue growth exceeding 5% after implementing dynamic pricing[8].

Dynamic pricing isn’t a one-and-done process. Continuous monitoring is essential to adapt to changing market conditions and competitor strategies. Schedule regular reviews to align your pricing strategy with market performance and insights from your data.

Be wary of common pitfalls. Over-relying on technology without human oversight, making price changes too frequently, or failing to communicate adjustments effectively can harm customer relationships. For example, some companies have successfully increased prices by up to 60% on certain products without losing volume[16]. This requires careful execution and strong customer trust.

Maintain data integrity with regular audits and validations. Effective change management is also crucial, as sales teams may resist dynamic pricing if they feel it threatens their autonomy or commissions. Address these concerns through targeted training for analysts, managers, and executives. Invite feedback from your team to improve the model and build their confidence in the system.

Lastly, develop clear customer communication strategies. Transparency is critical, especially for long-term contracts or complex solutions. Explain how your pricing works and the value it delivers, framing dynamic pricing as a fair and competitive approach rather than just a price increase.

Encourage a culture of continuous improvement. Dynamic pricing requires ongoing attention and adjustments to stay effective in an ever-changing market.

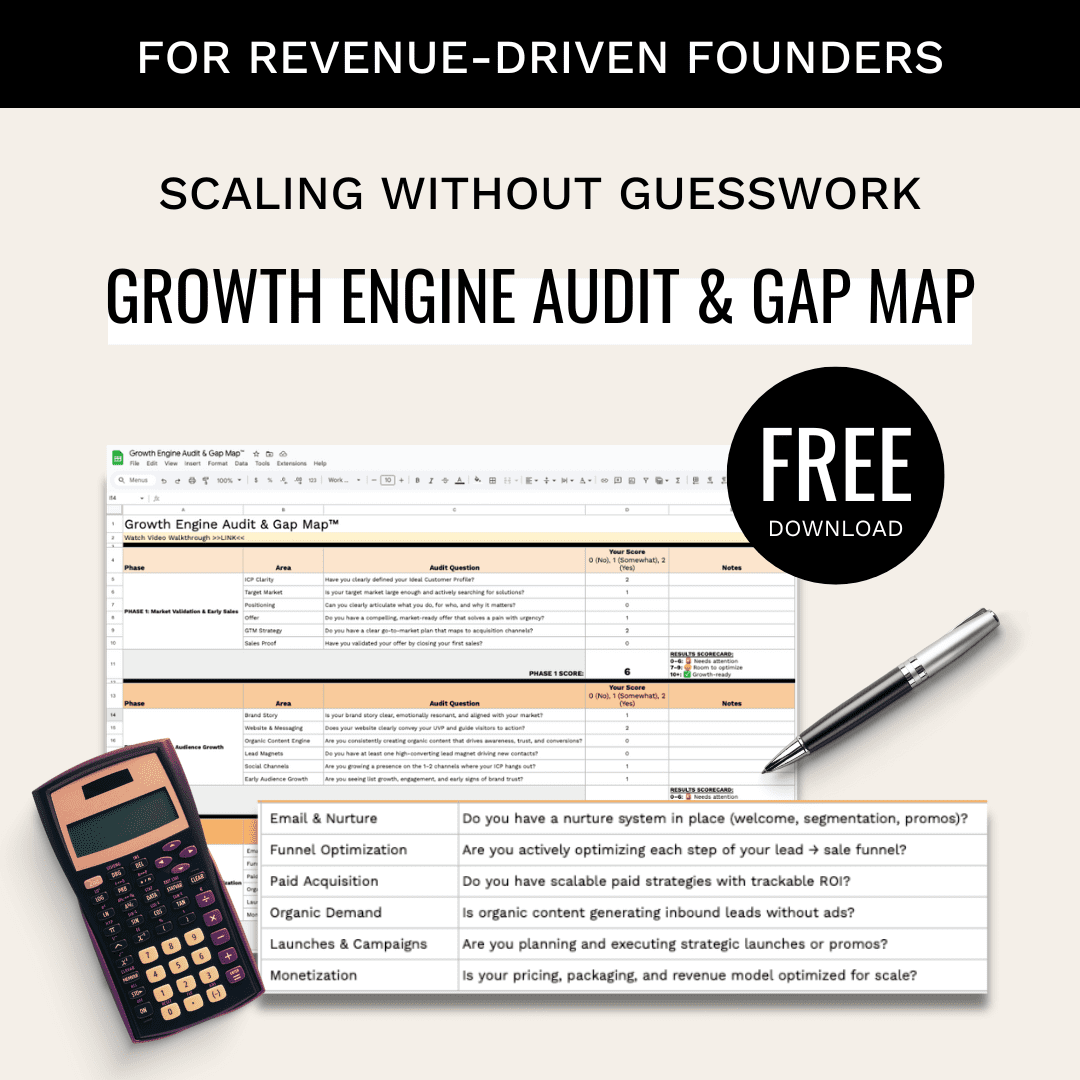

Data-Mania‘s Support for Dynamic Pricing Strategies

Dynamic pricing can be a game-changer, especially for B2B tech companies looking to stay competitive. Data-Mania steps in as a partner to help businesses execute these strategies with precision. By blending data analytics with go-to-market expertise, Data-Mania ensures pricing models are not just theoretical but actionable. This combination of technical know-how and strategic insight lays the foundation for the dynamic pricing solutions outlined below.

Data-Mania’s Pricing Strategy Services

Under the leadership of Lillian Pierson, Data-Mania offers services that combine analytical depth with marketing finesse to reshape pricing strategies. Their Fractional CMO services go beyond surface-level adjustments, integrating pricing optimization into broader business goals. Whether a company is aiming to boost market share, maximize profits, or speed up sales cycles, Data-Mania ensures pricing strategies align seamlessly with these objectives.

For early-stage SaaS startups, the focus is on refining target audiences and building scalable pricing models. Meanwhile, growth-stage companies benefit from strategies that merge dynamic pricing with funnel optimization and customer base expansion, ensuring pricing adjustments support overall growth.

Data-Mania employs advanced analytics and AI-driven insights to turn pricing into a proactive tool rather than a reactive one. Their approach includes evaluating existing data, applying sophisticated analytics, and integrating these insights into a company’s current systems.

"Fractional CMOs provide the strategic oversight that companies need without overextending their budgets. It’s about finding the leanest, most efficient path to growth." – Lillian Pierson [18]

For businesses with specific challenges, the Power Hour advisory sessions offer a targeted solution. These 60-minute consultations deliver actionable advice tailored to immediate pricing concerns, making expert guidance accessible even for companies with tighter budgets.

These services are designed to deliver tangible results, setting the stage for measurable growth, as explored further in the following sections.

Why Choose Data-Mania

What makes Data-Mania stand out? It’s their ability to combine engineering precision with marketing expertise. Lillian Pierson’s background ensures a solid analytical foundation for tackling complex pricing models, all while keeping an eye on practical, real-world outcomes.

Their KPI-focused approach guarantees that dynamic pricing implementation drives measurable success. Clients can see the direct benefits of their optimized pricing strategies, whether that’s improved revenue, better customer retention, or increased market share.

Another key advantage is cost efficiency. With full-time CMOs commanding salaries of around $352K annually [17], Data-Mania’s Fractional CMO service offers top-tier leadership at a fraction of the cost. This is especially appealing for tech companies that need sophisticated pricing strategies but aren’t ready to commit to a full-time executive.

Data-Mania’s expertise spans multiple tech sectors, including AI, SaaS, fintech, cybersecurity, and cloud services. This broad experience allows them to address the unique pricing challenges faced by different B2B tech verticals.

The company’s customized approach ensures pricing strategies are tailored to a company’s specific needs. Instead of applying cookie-cutter solutions, Data-Mania develops frameworks that reflect each business’s competitive landscape, target customers, and overall goals.

Finally, their focus on long-term partnerships sets them apart from traditional consulting firms. Data-Mania doesn’t just deliver short-term fixes – they work to create sustainable, repeatable growth strategies that adapt to changing market conditions. This ensures that pricing strategies remain effective as companies scale and markets evolve.

For tech companies ready to leave outdated pricing models behind, Data-Mania offers the strategic vision and analytical expertise to implement dynamic pricing effectively, all while keeping long-term growth in focus.

Conclusion and Key Takeaways

Dynamic pricing has become a must-have for B2B tech companies navigating today’s fast-moving markets, thanks to advancements in analytics and system integration[3]. Businesses adopting these strategies often see revenue boosts of 2–5% and margin improvements of 5–10%[4]. These gains can play a pivotal role in shaping a company’s competitive standing.

Modern pricing models are no longer static – they evolve to meet the demands of B2B buyers who expect personalized, real-time pricing. Static models simply can’t keep up with the rapid pace of today’s business environment[1][3]. With the help of cutting-edge technologies, companies can now predict market shifts before they happen, rather than scrambling to react afterward[3].

Technologies like AI and machine learning are at the heart of this transformation. They power real-time, data-driven pricing adjustments that not only improve margins but also enhance customer satisfaction[1][3][4]. When integrated with ERP and CRM systems, these tools create a cohesive pricing framework that responds instantly to changes in the market, competitor actions, and customer behaviors.

To get started, focus on a pilot program within select product lines. Pair pricing tools with existing ERP and CRM systems to enable real-time adjustments[4]. This phased approach reduces risk, ensures actionable insights, and builds cross-functional support.

However, dynamic pricing isn’t a “set it and forget it” solution. It demands constant monitoring and fine-tuning[4]. Keeping an eye on KPIs like net price realization, revenue growth, and inventory turnover ensures that your pricing strategies stay effective as market conditions shift. Companies that thrive with dynamic pricing treat it as an evolving system that requires ongoing care and optimization.

Delaying implementation can put your business at a disadvantage. Competitors already leveraging data-driven pricing strategies are securing deals, optimizing margins, and building stronger customer relationships. The real question isn’t whether to adopt dynamic pricing – it’s how quickly you can roll it out effectively while staying flexible enough to adapt as your business and the market evolve.

FAQs

How can B2B tech companies use AI and machine learning to enhance their dynamic pricing strategies?

B2B tech companies have a powerful ally in AI and machine learning when it comes to building smarter pricing strategies. These technologies can sift through massive datasets – covering everything from industry trends to customer behavior and operational costs – to enable real-time price adjustments that boost both revenue and profit margins.

By analyzing historical data, AI tools can also simulate various pricing scenarios, giving businesses the ability to forecast outcomes and fine-tune their pricing models. This means companies can adapt quickly to market shifts, make more precise decisions, and stay ahead in the fast-moving B2B world.

How can B2B tech companies ethically monitor competitor pricing without breaking the law?

To keep an eye on competitor pricing while staying ethical and within legal limits, stick to gathering data from publicly available sources. This includes competitor websites, online marketplaces, and any reports they share openly. Avoid crossing any lines, such as hacking, unauthorized access to data, or breaking terms of service agreements.

Equally important is steering clear of illegal practices like price-fixing or collusion, which can lead to serious legal trouble. Focus on transparency and ensure your data-gathering methods align with laws and industry rules. By following these ethical guidelines, you can gain useful insights without putting your business at risk of legal or reputational issues.

How can B2B tech companies address customer concerns about dynamic pricing models?

To ease customer concerns about dynamic pricing, B2B tech companies should prioritize clear communication and transparency. Explain how pricing is determined, emphasizing its connection to value, market trends, and specific customer needs. Offering reassurances, like commitments to fair pricing or stability, can go a long way in building trust.

It’s also important to spotlight the advantages of dynamic pricing for customers, such as more competitive rates or customized solutions. By addressing concerns head-on and showcasing the benefits, companies can minimize pushback and strengthen their relationships with customers.

Related Blog Posts

- 5 Ways AI Can Optimize Marketing ROI for your Tech Startup

- 5 Steps To Identify B2B Customer Pain Points

- AI Lead Scoring: Basics for B2B Marketing

- Ultimate Guide To VoC Feedback Loop Strategies