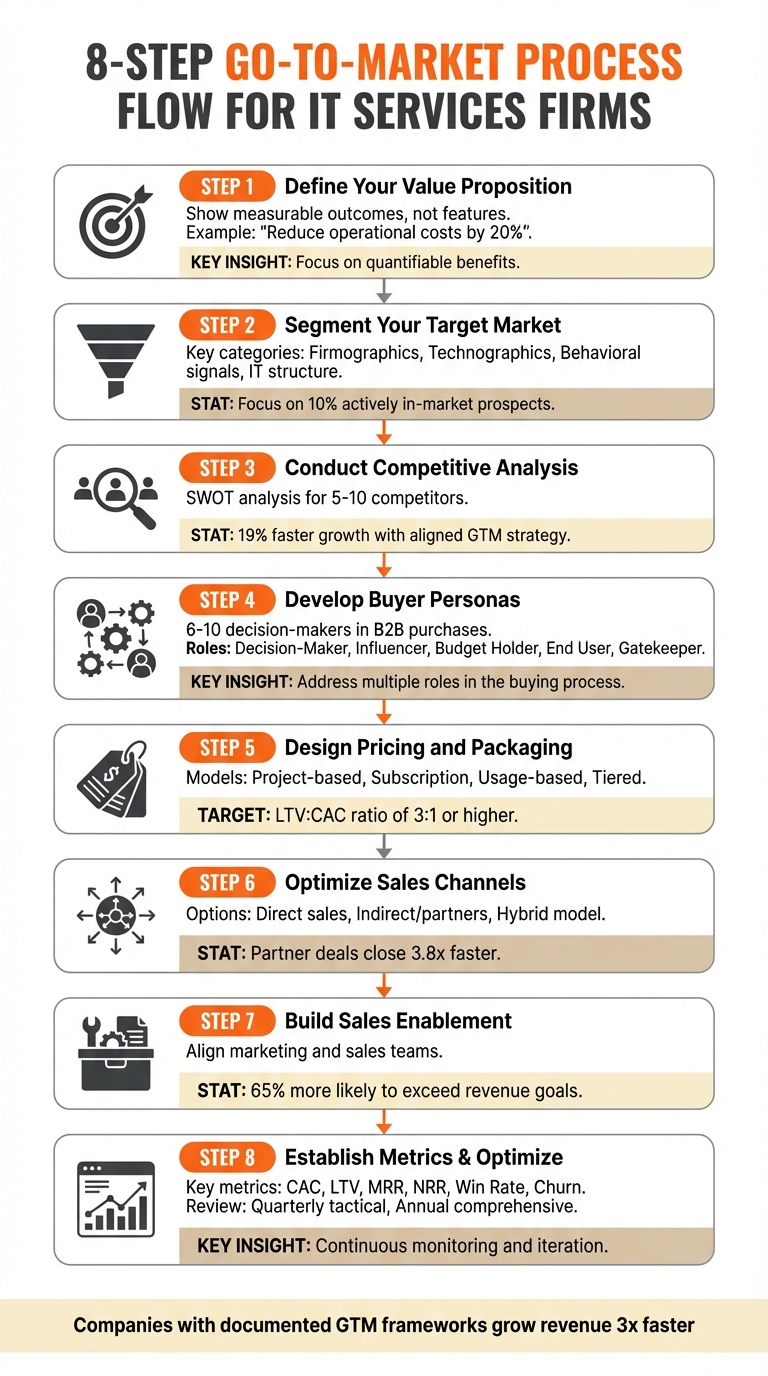

Struggling to scale your IT services firm beyond referrals? Here’s the reality: without a clear go-to-market (GTM) process, you’re wasting time, money, and effort. Companies with a documented GTM framework grow revenue 3x faster, yet most firms lack one. This guide gives you an 8-step playbook to fix that.

Key Takeaways:

- Why GTM matters: Aligns teams, reduces inefficiencies, and improves conversion rates.

- Common challenges: Talent shortages, long buying cycles, and unclear messaging.

- The 8 steps:

- Define your value proposition.

- Segment your market.

- Analyze competitors.

- Build buyer personas.

- Design pricing and packaging.

- Optimize sales channels.

- Enable sales and marketing alignment.

- Track metrics and refine continuously.

By the end, you’ll have a repeatable framework to grow your firm without relying on founder-led sales. Let’s dive in.

8-Step Go-to-Market Process Flow for IT Services Firms

Go To Market Plan – 6 Steps to Creating a Go-to-Market Plan

Step 1: Define Your IT Services Value Proposition

Your value proposition – what you do, who you serve, and why clients should choose you over sticking with their current solutions – sets the stage for your entire go-to-market (GTM) strategy. Without this clarity, your messaging risks sounding generic, making it tougher for potential clients to see why they should make a change.

The goal? Show clear, measurable outcomes instead of just listing technical features.

How to Pinpoint Your Core Offerings

Start by defining exactly what you provide. Be specific – don’t settle for broad terms like "managed IT support" or "cloud solutions." Are you delivering 24/7 network monitoring? Cloud migration tailored for mid-sized healthcare providers? Or perhaps cybersecurity assessments designed for financial services firms?

Highlight what your clients can accomplish with your services. For instance, instead of saying, "we offer AI-powered analytics", try: "our analytics deliver real-time insights that reduce operational costs by 20%"[6].

To refine this, tap into feedback from your sales team, CRM data, and a SWOT analysis to uncover recurring challenges your customers face. This ensures your services align with real-world needs[2][5][9].

"You need to understand exactly what your customers need and build to that."

Voice of the Customer (VoC) research is another powerful tool. Use interviews, surveys, and focus groups to identify gaps in existing solutions[10]. On discovery calls, ask questions like, "If we solve this problem, how would it impact your company and you personally?"[12]. These conversations often reveal both practical benefits – like saving time or money – and personal gains, such as reduced stress for an overworked IT director[5].

| IT Service Pain Point | Your Core Offering | Tangible Business Outcome |

|---|---|---|

| Sophisticated cyber threats | Advanced threat detection and 24/7 monitoring | Reduced risk of data breaches and downtime[4] |

| IT talent gap/staffing shortages | Access to specialized experts on-demand | Lower recruitment costs and immediate scalability[4] |

| Complex, manual forecasting | AI-driven automated analytics and reporting | 30% improvement in forecast accuracy[6] |

| High operational overhead | Cloud migration and infrastructure optimization | 20% reduction in operational costs[6] |

Once you’ve nailed down what you offer, shift your attention to communicating these benefits in a way that speaks to a variety of decision-makers.

How to Communicate Benefits and Stand Out

After defining your core offerings, the next step is to present them in a way that appeals to the diverse group of stakeholders involved in most B2B purchases. Today, a single buying decision often includes six to ten people[6]. For example, a CFO might focus on ROI and cost savings, while an IT manager cares more about system reliability and security.

To address this, map your features to outcomes that matter to each stakeholder. For a CFO, emphasize how your managed services cut costs. For an IT manager, highlight benefits like continuous monitoring and proactive support[6].

Your differentiators often lie in how you deliver your services. Do you assign a dedicated account manager? Use a proprietary onboarding process that speeds up implementation? These details matter. Consider creating a "Proven Process" graphic – a visual roadmap that clearly outlines what clients get and how you deliver it[12].

Case studies and testimonials are also essential for reinforcing your value proposition[12].

"Value isn’t about what you do; it’s about what your customer can achieve because of what you do."

- Natalie Ruiz, AnswerConnect[12]

Finally, test your messaging through A/B experiments or small pilot groups to see what resonates most with your audience[5][11]. This iterative approach ensures your messaging hits the mark. Companies that align strong advertising with a clear value proposition have seen 168% growth over a decade[10].

Step 2: Segment Your Target Market

After defining your value proposition, the next move is splitting your market into focused groups. Without clear segmentation, you risk spreading your resources too thin, making it tough to craft messages that resonate with the right buyers.

Effective segmentation goes beyond just company size. It includes firmographics (like industry, revenue, and employee count), technographics (such as their existing tech stack and software usage), and behavioral signals (like website visits to pricing pages or whitepaper downloads). For IT services firms, understanding a prospect’s IT organizational structure is crucial. For instance, does the company rely on a single IT manager or have a robust in-house team? This insight helps you gauge the level of support they might need[4]. By taking this holistic view, you can pinpoint which segments are most likely to convert.

A great example of segmentation success comes from MetLife. In 2015, they used machine learning and big data clustering on 50,000 customer profiles, which led to $800 million in acquisition cost savings over five years[16].

Criteria for Market Segmentation

To begin, map out the variables that are most relevant for IT services. Industry vertical is a key factor – industries like healthcare and finance face vastly different compliance and operational challenges. While company size is important, pair it with financial indicators like IT spend or EBITDA for a clearer understanding of budget capacity[1].

Technographic data is another valuable tool. Knowing what software and systems a prospect uses can reveal how advanced their IT environment is and how open they might be to adopting new solutions[13]. For example, the presence of a CTO or other high-level technical leadership often indicates a more developed IT operation[1].

Equally important are behavioral and intent signals. Digital footprints – like visits to your pricing page, whitepaper downloads, or searches for keywords such as "managed IT support for healthcare" – indicate active interest. Focusing on prospects with high buyer intent can significantly boost conversion rates, potentially reaching 20%, compared to the typical 2%[15].

| Segmentation Category | Primary Variables |

|---|---|

| Firmographics | Industry vertical, revenue size, number of employees, location[1] |

| Technographics | Current tech stack, IT sophistication, presence of CTO, software adoption rates[13][1] |

| Behavioral | Purchase history, M&A activity, website intent signals, consumption patterns[13][1] |

| IT Structure | Department size (thin vs. large), in-house expertise gaps, staffing challenges[4] |

| Financials | IT spend by category, revenue growth, EBITDA[1] |

Prioritizing High-Potential Segments

Once you’ve identified your segmentation criteria, the next step is prioritizing which groups to target first. Focus on segments with the highest ROI potential. The Fit-Need-Intent Framework can help: score each segment based on how well they match your ideal customer profile (fit), whether they have a pressing problem to solve (need), and if they’re actively seeking solutions (intent)[15].

"The ideal customer profile is arguably the most important part of your GTM strategy because if you get that profile wrong, every strategy and tactic built around it won’t align with real customer needs, pain points, and preferences."

- Rex Huxford, Director of Demand Generation, MD Clarity[5]

Prioritize segments that already recognize their need and are allocating resources to address IT challenges. These prospects are much more likely to convert than those who haven’t yet identified their pain points[15]. Keep in mind that only about 10% of your target market is actively "in-market" at any given time, so focusing on those showing clear intent is critical[15].

Next, assess coverage economics. Does the segment’s average selling price (ASP) and long-term value (LTV) justify the cost of field sales, or would inside sales or channel partners be more effective?[1] For instance, a managed services provider might find that companies with 50–500 employees, minimal in-house IT staff, and a budget for regular equipment updates offer the best balance of revenue potential and service costs[7].

Leading firms are moving away from "inductive" segmentation, which relies on salesperson input, to deductive models powered by machine learning and AI. This approach eliminates organizational bias and identifies ideal customer traits directly from the data[1].

Step 3: Conduct Competitive Analysis

After segmenting your market, the next logical step is to understand your competition. Competitive analysis helps you uncover what sets your business apart. Start by identifying both direct competitors – those offering similar IT services to the same audience – and indirect competitors, who solve similar problems with alternative approaches[17]. To get a well-rounded perspective, analyze a mix of 5–10 competitors, including established companies and up-and-coming startups.

Your research should include both primary and secondary methods. Primary research could involve interviewing customers who chose competitors, surveying lost opportunities, or even purchasing a competitor’s service to evaluate it firsthand. Secondary research might include reviewing competitors’ websites, analyzing their social media activity, and using SEO tools like Ahrefs or SEMrush to examine keyword rankings and traffic patterns[17]. For IT services, pay close attention to pricing structures (e.g., subscription vs. tiered models), customer support quality, and how they present their brand across different marketing channels[17]. This analysis forms the foundation for refining your go-to-market (GTM) strategy in future steps.

Mapping Your Competitors

A great way to start is by conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for each competitor. This approach lets you evaluate their internal strengths – such as technical expertise, service efficiency, or customer retention – while also considering external factors like market trends or regulatory shifts[17][2]. For IT services, understanding the technology stack your competitors use is essential. Tools like Wappalyzer and BuiltWith can reveal their tech stacks, helping you identify operational advantages or limitations[19][22].

"Treat our competitive intelligence as ammunition. [It] tells you what the competition is doing, in advance. So that you can defend yourself and counter-attack."

Organize your insights by visually comparing competitors on key factors such as market presence and customer satisfaction. Create a feature-by-feature comparison that includes pricing, usability, support quality, and other critical metrics. This method helps you identify areas where competitors might be excelling – or falling short.

To stay ahead, automate competitor monitoring using tools like Visualping or Crayon, which can alert you when competitors make changes to their pricing or services pages[21][23].

Identifying Market Gaps

Using your GTM framework, pinpoint gaps where competitors aren’t meeting customer needs. AI-powered tools and large language models (LLMs) can help analyze competitor reviews, social media posts, and support tickets to gauge customer sentiment. Sort feedback into positive, negative, or neutral categories to uncover common frustrations or unmet demands[5].

Look for underserved opportunities, such as highly specialized niches or geographic areas that larger competitors may overlook[2][18]. For example, if national IT firms are neglecting mid-sized healthcare providers in the Midwest, you could position yourself as the go-to expert for that segment. Establishing yourself as the "local specialist" in a niche market often paves the way for broader expansion.

Data shows that organizations with well-aligned GTM strategies grow 19% faster and are 15% more profitable than their competitors[18]. Treat your competitive analysis as a dynamic resource. The IT services market evolves quickly – new technologies emerge, customer preferences shift, and competitors adapt. Update your analysis quarterly to stay relevant[17]. Avoid relying on gut instincts or internal biases about being "the best" in your field. Instead, let data and metrics guide your strategy[17].

Step 4: Develop Buyer Personas

After completing your competitive analysis, the next step is diving into the minds of those making IT service purchase decisions. A buyer persona goes beyond just job titles; it’s a detailed profile that captures your ideal customer’s goals, challenges, and decision-making factors[7]. For IT services firms, this means distinguishing between a CIO prioritizing strategic ROI and an IT Manager focused on operational hurdles.

Most B2B IT purchases involve 6 to 10 decision-makers[7]. These include Initiators who identify the need, Influencers who confirm technical fit, Decision-Makers (often CIOs or CTOs) who give final approval, Budget Holders like CFOs who manage spending, and Gatekeepers in procurement who control access to vendors. Alarmingly, 75% of marketers report dissatisfaction with their GTM outcomes, frequently because they rely on assumptions rather than data-driven personas[26].

To build effective personas, start by interviewing 10–15 recent customers and prospects, including those who chose competitors, to uncover their decision-making rationale[27]. Collaborate with sales and support teams to identify recurring objections and traits of successful clients[28]. Dive into your CRM, LinkedIn profiles, and AI tools to analyze support tickets and call transcripts, looking for patterns in how IT decision-makers articulate their challenges[24]. Your aim is to capture demographic, psychographic, and behavioral details, creating a well-rounded picture of your buyers.

Key Elements of Effective Buyer Personas

A strong buyer persona for IT services should include three core layers:

- Demographics: Cover job titles, company size, industry, and budget authority. For example, a CTO at a mid-sized healthcare firm will likely have different priorities than an IT Manager at a small fintech startup.

- Psychographics: Explore professional goals, concerns like compliance with GDPR or HIPAA, and attitudes toward digital transformation[27][28].

- Behavioral Data: Understand how decision-makers prefer to consume information – whether through whitepapers, webinars, or LinkedIn discussions – and their typical interactions with vendors[27].

Adele Revella, CEO of the Buyer Persona Institute, emphasizes focusing on the "5 Rings of Buying Insight": Priority Initiatives (why they’re in the market), Success Factors (what they hope to achieve), Perceived Barriers (reasons they might hesitate), the Buyer’s Journey (what influences their decisions), and Decision Criteria (how they evaluate options)[27]. For IT services, this means documenting details like current infrastructure, budget limitations, and technical needs[2][7]. The Pareto principle is a helpful guide – about 80% of your revenue likely comes from 20% of your customers, so prioritize profiling these high-value segments[27].

| Persona Role | Primary Focus | Key GTM Contribution |

|---|---|---|

| Decision-Maker | Strategic alignment, ROI | Gives final approval for the purchase |

| Influencer | Technical feasibility, security compliance | Provides internal validation for the solution |

| Budget Holder | Cost-benefit analysis, financial risk | Controls spending and contract terms |

| End User | Usability, reliability | Drives long-term product adoption and retention |

| Gatekeeper | Access control, vendor qualification | Manages the flow of information to executives |

Regularly update your personas to reflect changes in the IT landscape and market conditions[25][28]. Assign descriptive names like "IT Ian" or "CTO Carla" to make them easier for your team to reference during strategy discussions[7].

How to Use Personas in Your GTM Strategy

Once you’ve defined your buyer personas, integrate these insights into every aspect of your GTM strategy. Start by creating a value matrix that aligns your service features with each persona’s pain points[7][24]. For instance, a CIO might prioritize strategic ROI and staying competitive, while an IT Manager might focus on ease of implementation and reliable support.

Tailor your GTM tactics to address these distinct priorities. Develop persona-specific discovery questions, objection-handling scripts, and case studies that resonate with each role. Match your content to the buyer’s stage in the journey – use whitepapers for early awareness, case studies for consideration, and product demos for the decision phase[6][7]. Additionally, consider creating "anti-personas" to identify unideal customers, helping you avoid wasting resources on low-potential leads[30].

Personas also serve as a unifying framework for your sales, marketing, and product teams. When everyone speaks the "voice of the customer", whether in a blog post or a sales pitch, your messaging becomes consistent and impactful[29][8]. Companies with a documented GTM framework report a 10% higher success rate in product launches, and those with formal playbooks achieve three times the revenue growth compared to those without one[6]. By understanding not just who your customers are but also why they buy and what keeps them up at night, you can make your entire GTM strategy more focused and effective. These personas are invaluable for bridging the gap between identifying market needs and executing targeted strategies, especially as you move into pricing and packaging in the next step.

sbb-itb-e8c8399

Step 5: Design Pricing and Packaging Strategies

Once you’ve developed detailed buyer personas, the next step is crafting pricing and packaging strategies that directly address your customers’ priorities. Pricing plays a pivotal role in shaping how your business is perceived, attracting the right customers, and keeping them engaged. As Greg Leach from ProductLed explains:

"Pricing is a critical piece of your business because it dictates your go-to-market (GTM) strategy, positioning, value prop, and retention" [31].

The challenge lies in finding the sweet spot between what customers are willing to pay and your company’s financial goals. Pricing is a delicate mix of strategy and adaptability, requiring ongoing adjustments based on market feedback [31].

For B2B services, a strong Lifetime Value (LTV) to Customer Acquisition Cost (CAC) ratio – typically 3:1 or higher – is a good benchmark [6]. This means that every dollar spent acquiring a customer should generate at least three dollars in return. Additionally, renewals and upsells account for roughly 40% of total SaaS revenue [14]. Companies with a structured GTM framework often experience revenue growth that’s three times faster than those without one [6].

Choosing the Right Pricing Models

IT services firms generally rely on four common pricing models, each suited to specific service types:

- Project-based pricing: Ideal for one-time projects like cloud migrations or system integrations. Costs are tied to specific milestones.

- Subscription pricing: Offers predictable monthly or annual fees for ongoing managed services.

- Usage-based pricing: Charges are based on consumption metrics, such as per-user seats, gigabytes of storage, or API calls.

- Tiered pricing: Groups features into levels (e.g., Basic, Pro, Enterprise), catering to different customer segments [31][24].

To refine your pricing, conduct competitive analyses to understand how peers price their services, structure tiers, and communicate value. Feature preference surveys can also help identify which offerings customers care about most. A useful tool here is the Van Westendorp Model, which asks prospects four questions to determine their acceptable price range: what feels like a bargain, what seems too cheap, what’s expensive but acceptable, and what’s simply too expensive [31]. When launching, it’s often better to price at the higher end of this range, as lowering prices later is easier than raising them without upsetting customers [31].

Companies like Dropbox and Gusto provide great examples of pricing strategies. Dropbox differentiates tiers based on usage and feature bundles, while Gusto combines flat subscription fees with per-seat charges [31]. Xero, on the other hand, limits the number of invoices and bills in its lower tiers to encourage upgrades. These examples highlight how pricing must align with both market expectations and your overall GTM strategy. Whether you’re adopting a product-led (freemium or self-service) or sales-led (custom quotes and demos) approach, your pricing should reflect that [24]. Be transparent about any additional fees, such as setup costs, usage overages, or cancellation charges [31].

Creating Service Bundles

Service bundles should address specific customer pain points while offering clear value. Start by building a value matrix that connects each buyer persona to their primary challenges and the service components that resolve them [32]. For instance, a CFO may focus on cost savings, while an IT Manager might prioritize seamless implementation and reliable support. Since B2B purchases often involve six to ten decision-makers, your bundles should appeal to a range of stakeholders [6].

Organize your offerings into tiers. For example, Tier 1 could target high-LTV, ready-to-buy customers, while Tier 2 focuses on prospects in the nurturing stage. Design these bundles with a “land and expand” strategy – allow customers to start with core services and add more as their needs grow [1][34]. Test your bundles with a small customer group and tweak them based on feedback [33]. Clearly defining the entry and exit criteria for each tier can help customers understand when it’s time to upgrade [33].

Using frameworks like “Jobs-to-be-Done” ensures your bundles address specific customer needs comprehensively. The goal is to simplify the buying process by clearly showcasing the value of your services.

Step 6: Optimize Sales and Distribution Channels

With your pricing and packaging finalized, the next step is to figure out the best sales channels for your business. The ideal channel depends on factors like the complexity of your service, deal size, and the level of customer support required. IT services firms typically choose between direct sales (in-house teams), indirect sales (partner networks), or a hybrid model that combines the two. Your channel strategy should align with your pricing model and the complexity of your offerings to ensure success.

Direct sales gives you complete control over customer relationships and messaging but comes with higher fixed costs, such as salaries, training, and overhead. Field sales works best for high-value enterprise deals that require in-person meetings and navigating lengthy sales cycles with key decision-makers [5][6]. Inside sales, on the other hand, relies on remote outreach – using calls, emails, and video meetings – and is more efficient for mid-market deals where face-to-face meetings aren’t cost-effective [5][6].

Indirect channels, like Value-Added Resellers (VARs), System Integrators, or affiliates, allow you to scale quickly by leveraging established networks. Deals driven by partners tend to close 3.8 times faster than those from outbound or paid channels [39]. However, this comes at the cost of sharing margins and relinquishing some control [37][40].

If your Average Selling Price (ASP) and Customer Lifetime Value (LTV) can justify the expense of a dedicated sales team, direct sales might be the way to go. If not, partners can help you grow without significant upfront investment [1].

"Sales-led strategies focus on relationship-building to push customers to convert, while product-led strategies work by leveraging the product itself to pull customers to convert." – Rex Huxford, Director of Demand Generation, MD Clarity [5]

For simpler, lower-cost tools, a self-service model with automated onboarding may be the most efficient choice [5][6]. This decision lays the groundwork for the detailed channel strategies outlined below.

Direct vs. Indirect Sales Channels

Choosing between direct and indirect channels isn’t an either/or decision – many IT firms use both. Direct sales are ideal for complex, high-trust services like cybersecurity assessments or custom cloud architecture. Indirect channels, however, excel when you need to expand geographically or when your service fits into broader projects managed by partners. For instance, System Integrators can incorporate your managed services into enterprise-wide IT transformations [39].

Direct sales provide higher margins and deeper customer insights but require more time to scale and demand significant staffing. Indirect channels, in contrast, reduce upfront costs and speed up market entry but come with lower per-deal earnings and a reliance on partners to represent your brand effectively [37][39][40]. To ensure your partners succeed, equip them with resources like "sales on-sheets", call scripts, and competitive comparisons to help them prioritize your services over others [37].

A good rule of thumb: use direct sales for bespoke, high-value consulting and rely on indirect channels for standardized service bundles [39].

Leveraging Digital Platforms for Lead Generation

In addition to direct and partner channels, digital platforms can significantly boost your lead generation efforts. LinkedIn is a top choice for B2B outreach, with 65 million decision-makers and four out of five users influencing business decisions [37][38]. Use LinkedIn’s targeting tools to reach specific personas and industries, sharing educational content that tackles technical challenges [5][6]. Meanwhile, Google Ads is excellent for capturing high-intent prospects actively searching for solutions. Keywords with transactional intent convert at an average rate of 4%, compared to just 0.5% for display ads [38]. Organic search (SEO) is another powerful tool, delivering an average 5.0% conversion rate in B2B [39].

Beyond paid channels, marketing automation platforms like HubSpot or Pardot can nurture leads through personalized drip campaigns tailored to their stage in the buyer’s journey [35][36]. By integrating these platforms with your CRM, you can automate lead scoring, helping sales teams focus on the most promising prospects [35][7].

For an even sharper edge, intent data platforms like 6sense or Demandbase identify accounts actively researching IT solutions, transforming cold outreach into "in-market" engagement [35][36]. Businesses using account intelligence tools save sales reps more than eight hours per week and increase pipeline creation by up to 40% [6].

To maximize impact, align your content with the buyer’s journey: use blog posts and webinars for early awareness, case studies and demos for consideration, and free trials or direct sales calls for the decision-making stage [6].

Step 7: Build Sales Enablement and Marketing Tactics

Your sales channels are set up, but your team still needs the right tools and content to close deals effectively. Sales enablement bridges the gap between marketing and sales by equipping reps with approved materials, training, and on-demand support. Companies that invest in dedicated sales enablement teams are 65% more likely to exceed revenue goals, and reps using enablement content outperform their peers by 58% [41]. Without these tools, sales reps waste valuable time searching for information or, worse, sharing outdated details that can erode buyer trust.

Start by creating a focused sales playbook that consolidates essential resources. This should include competitive battle cards, scripts for handling objections, ideal customer profiles (ICP), and messaging tailored to IT decision-makers [42][6]. Use a knowledge management tool like Guru or Confluence to ensure reps have instant access to key information – such as product specs, security FAQs, and pricing – during live calls. This is crucial since 92% of customer interactions happen in real-time [42]. Additionally, tools like Gong or Chorus can analyze sales calls, highlight successful strategies, and help coach reps to improve performance [42].

By integrating these tools and strategies, you complete the go-to-market (GTM) cycle, empowering your team to turn leads into customers. Once your sales enablement framework is in place, the next step is to create sales collateral that resonates with IT buyers.

Creating High-Impact Sales Collateral

Your sales materials should focus on solving IT buyers’ challenges with clear, outcome-driven messaging – not just a list of features. For instance, instead of highlighting "AI-powered analytics", demonstrate how your solution "reduces operational costs by 20%" [6]. Tailor your content to align with the buyer’s journey: use blog posts and webinars to build awareness, case studies and comparison guides to help with evaluation, and ROI calculators and product demos to support decision-making [6][42].

Given that a typical B2B purchase involves six to ten decision-makers, it’s essential to create persona-specific materials. For example:

- CFOs need total cost of ownership (TCO) reports.

- IT managers benefit from detailed technical demos.

- Security officers require compliance documentation [6][7].

A real-world example of effective sales enablement comes from Viant Technology, an AdTech company. In 2024, they adopted the Highspot GTM performance platform to centralize sales resources and streamline team alignment. This move led to a 109% increase in rep participation in enablement programs, allowing marketers to maintain oversight while enabling reps to access the tools they need to close deals faster [45].

Once your sales tools and collateral are in place, it’s time to ensure your marketing efforts align seamlessly with sales objectives.

Aligning Marketing Campaigns with Sales Goals

For marketing and sales to succeed, they need to work toward shared revenue goals – not just metrics like lead volume or website traffic [43]. Start by collaborating on a unified Ideal Customer Profile (ICP) and a target account list that prioritizes high-value customers with strong retention potential [43]. Next, establish Service Level Agreements (SLAs) to define how quickly sales should act on leads prioritized by marketing. This is critical, as 53% of companies report breakdowns in the handoff process, with sales following up on fewer than 35% of engaged prospects [43].

To maintain alignment, schedule weekly "smarketing" meetings to review pipeline performance, evaluate campaigns, and analyze win-loss data. Encourage marketing teams to sit in on sales calls to better understand objections and refine their strategies accordingly [44]. This ongoing feedback loop ensures that your webinars, whitepapers, and campaigns are designed to drive actual sales outcomes, not just generate leads.

Step 8: Establish Metrics and Continuous Optimization

To make your Go-to-Market (GTM) strategy effective, you need a clear way to measure and refine it. Without defined metrics, you’re essentially flying blind – unable to tell what’s working and what’s wasting time or money. Misalignment within GTM teams is a widespread issue, with 85% of professionals reporting it, and 89% believing it directly impacts revenue through lost deals and weaker pipelines [46].

"A GTM strategy isn’t about having all the answers on day one. It’s about creating a structured way to find those answers, test your assumptions, and adapt quickly based on what the market tells you." – Semir Jahic, Salesmotion [6]

Defining Key GTM Metrics

For IT services firms, tracking metrics that tie directly to revenue and efficiency is critical. Start with Customer Acquisition Cost (CAC), which breaks down how much you’re spending to bring in each new client, categorized by channel and campaign [46]. Pair that with Customer Lifetime Value (LTV) to evaluate long-term profitability; a healthy LTV to CAC ratio for B2B businesses is typically 3:1 or better [6].

Other essential metrics include:

- Sales Cycle Length: Measures the time from initial contact to a signed contract, helping you spot delays [46].

- Conversion Rates: Tracks performance at each funnel stage to identify bottlenecks [46].

- Monthly Recurring Revenue (MRR) and Net Revenue Retention (NRR): Key for subscription-based or managed services [46][35].

- Pipeline Velocity: Shows how quickly your sales team turns interest into closed deals [35].

- Win Rate: Highlights the percentage of qualified opportunities that result in sales [35].

- Churn Rate: Tracks customers who stop using your services, segmented by type, engagement, or product usage to uncover patterns [46].

If your CAC:LTV ratio skews heavily toward CAC – like 1:1 – it’s a red flag that your acquisition strategy isn’t sustainable and needs immediate adjustment [46][6].

Centralizing all these metrics in one single source of truth, such as Salesforce or HubSpot, ensures marketing, sales, and customer success teams are aligned [46][35]. Define precise Service Level Agreements (SLAs) for what qualifies as a Marketing Qualified Lead (MQL), and automate lead handoffs to avoid losing prospects [35]. Companies with a documented GTM playbook report three times the revenue growth, while those with a structured GTM framework see a 10% higher success rate in product launches [6][35].

Implementing Iterative Improvements

Improvement is never a one-and-done effort; it’s a continuous process. Establish a "leadership rhythm" by scheduling regular review meetings to assess GTM dashboards, track progress, and hold teams accountable [3]. Perform comprehensive reviews of your GTM framework annually, while making tactical tweaks – like refining messaging or adjusting targeting – every quarter [35][6]. If metrics slip, competitors make a bold move, or recurring objections surface during discovery calls, initiate an immediate review [6].

Take advantage of tools powered by AI to refine your approach. For example, use AI to analyze customer sentiment in support tickets and reviews, helping you identify common pain points and improve messaging [24]. Platforms like Salesforce Einstein can predict which leads are most likely to convert or estimate deal sizes [35]. Similarly, intent data platforms like 6sense or Demandbase can pinpoint accounts actively researching IT solutions, enabling your sales team to focus on “in-market” prospects instead of cold leads [35][6]. Notably, AI-native companies with over $100 million in annual recurring revenue (ARR) achieve a 56% funnel conversion rate, compared to 32% for their non-AI counterparts [35].

Run continuous A/B tests on value propositions and marketing channels, using segmented targeting to determine what resonates most before scaling campaigns [24][7]. Keep a close eye on Net Revenue Retention (NRR) to ensure you’re not just attracting customers but retaining and growing them [35]. This ongoing feedback loop sharpens your strategy and lays a solid foundation for driving growth in the final stages of your GTM journey.

Conclusion: Driving IT Services Growth with a Clear GTM Process

This guide laid out practical steps – from defining your value proposition to tracking ongoing metrics – to help you establish a strong Go-to-Market (GTM) process. A well-documented GTM framework isn’t just a nice-to-have; it’s a key driver of growth. Companies with a defined GTM strategy see three times the revenue growth compared to those without one, and they achieve a 10% higher success rate in product launches [6]. Yet, surprisingly, fewer than 33% of organizations have a formal GTM playbook [6], leaving a huge opportunity for IT services firms ready to invest in building one.

At the heart of a successful GTM strategy is a clearly defined Ideal Customer Profile (ICP). Rex Huxford, Director of Demand Generation at MD Clarity, emphasizes its importance:

"The ideal customer profile is arguably the most important part of your GTM strategy because if you get that profile wrong, every strategy and tactic built around it won’t align with real customer needs, pain points, and preferences" [5].

Once the ICP is in place, aligning sales, marketing, and product teams becomes critical. This alignment ensures consistent messaging and smooth execution across all touchpoints.

Your GTM strategy isn’t something you set and forget. Treat it as a living document. Plan to review it annually, while keeping an eye on key metrics like LTV:CAC ratios and sales cycle lengths on a quarterly basis [6]. If competitors make bold moves or customer feedback highlights new trends, be ready to adjust immediately [6]. The market evolves constantly, and your strategy should too.

Shifting from a traditional linear funnel to a flywheel model can also make a big difference. This approach prioritizes customer retention, upselling, and referrals, turning satisfied customers into long-term advocates. As Elaine Chen, Founder of Excogita, explains:

"You shouldn’t think of GTM as getting customers to make a one-time purchase, but rather starting an ongoing relationship with customers who will hopefully remain loyal over the years" [5].

By focusing on existing customers first – through retention, upselling, and referrals – you can manage acquisition costs while maintaining steady, predictable growth [7].

With nearly 95% of 30,000 new product launches each year failing [6], often due to misalignment between the sales process and the buyer’s journey, a GTM process is no longer optional. It gives you a structured way to test assumptions, adapt quickly to market changes, and leverage happy customers as your most effective sales tool. Use these principles to refine your GTM strategy and position your IT services firm for sustainable growth.

FAQs

What are the main advantages of having a documented Go-to-Market (GTM) process for IT services firms?

A well-documented go-to-market (GTM) process gives IT services firms a clear and repeatable framework, helping align teams such as product, marketing, sales, and delivery. By breaking down silos and ensuring everyone works toward shared objectives, it promotes smoother operations and better team collaboration.

This structured approach also speeds up time-to-market, ensures consistent execution, and delivers results that can be measured. With defined metrics, businesses can monitor progress, refine their strategies, and achieve steady revenue growth while hitting their goals more efficiently.

How can IT services firms use buyer personas to improve their GTM strategy?

Buyer personas are detailed profiles created through research, representing your ideal customers. They capture key aspects like goals, challenges, and decision-making habits. For IT services firms, these personas go beyond broad audience definitions, offering a focused understanding of who you’re targeting, the issues they face, and how your solutions can meet their needs.

To make buyer personas a valuable part of your Go-to-Market (GTM) strategy, start by collecting data from current clients, interviews, and market research. This helps you define each persona’s role, priorities, and challenges. Next, align these personas with your Ideal Client Profile (ICP) to pinpoint the industries, regions, and decision-makers that matter most. With this foundation, you can create messaging, content, and sales materials – like case studies or proposals – that directly address the concerns of each persona. Finally, integrate these personas into your GTM approach to prioritize leads, tailor outreach efforts, and track campaign performance. By doing so, your teams can deliver solutions that truly connect, leading to better engagement and growth.

What are the best pricing models for IT services, and how can they meet different customer needs?

IT services firms have several pricing strategies to cater to the varied needs of their clients:

- Fixed-price projects: This model works well for clients who need clear budget boundaries. It involves charging a set fee for a specific, well-defined task, like a one-time system migration.

- Time-and-materials: Perfect for projects where requirements may shift, this approach bills clients based on the actual hours worked and materials used, offering flexibility for projects that evolve over time.

- Subscription pricing: A recurring monthly fee, often calculated per user or device, covers ongoing services such as monitoring and support. This model is especially appealing to small and medium-sized businesses looking for predictable expenses.

By blending these strategies – such as fixed pricing for initial rollouts followed by subscription or value-based pricing for continued management – IT service providers can align with their clients’ budgets, risk tolerance, and business objectives.

Related Blog Posts

- How to Build a SaaS Marketing Strategy from Scratch

- SaaS Go-to-Market Strategy: Step-by-Step Framework

- Ultimate Guide to Cross-Functional PLG Alignment

- The AI GTM Engineer: The Missing Role Behind Scalable B2B Growth