Let me share a performance-based pricing example that completely transformed how one of my clients approaches enterprise deals.

This data consultant had all the technical chops you’d expect – deep specialization, real expertise, years of experience. But here’s what he didn’t have: clear market positioning, consistent inbound leads, or any systematic approach to landing enterprise clients. Sound familiar?

Then we started working together one-on-one, and everything changed.

“Pay me based on results. If I can’t solve your data problem and save you money, you don’t owe me anything. If I succeed, I earn a percentage of what you save.”

We didn’t just optimize his LinkedIn profile or tweak his messaging. We fundamentally repositioned him as THE go-to expert for enterprise data problems that others couldn’t solve. But here’s the real breakthrough – this positioning gave him the confidence to propose something most consultants would never dare:

“Pay me based on results. If I can’t solve your data problem and save you money, you don’t owe me anything. If I succeed, I earn a percentage of what you save.”

That’s confidence backed by strategic positioning. And it opened the door to a $750,000 performance-based contract that he delivered in under two weeks.

This performance-based pricing example isn’t just about creative contract structures. It’s about the power of positioning yourself as a category-of-one expert who stands behind their work with absolute confidence. Performance-based pricing is just one of many scalable options. There are other revenue models for startups in the tech and data space.

Understanding Performance-Based Pricing: Beyond the All-or-Nothing Myth

Most founders think performance contracts are either “all-risk” or “no-risk.” That’s why most attempts at performance-based pricing fail spectacularly.

What Performance-Based Contracts Actually Are: Think of them as shared ownership of outcomes. You’re not selling time or deliverables – you’re betting on measurable results. The client pays less upfront but shares meaningful upside when you hit (or exceed) targets.

The magic happens when you structure them correctly, which brings us to our next performance-based pricing example framework.

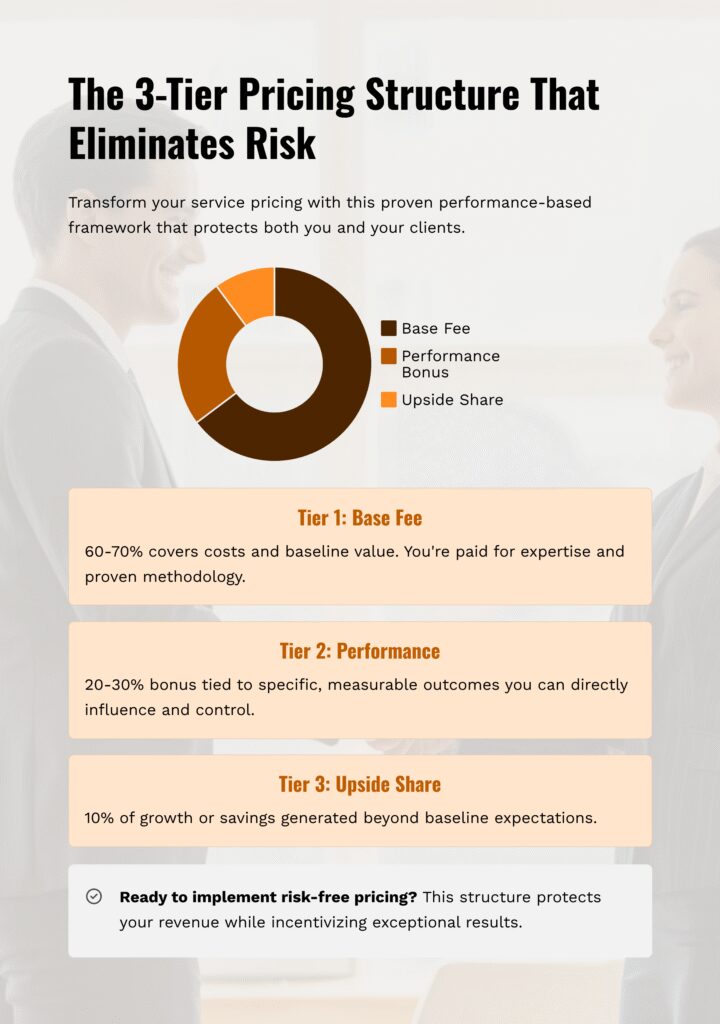

The 3-Tier Structure That Actually Works

Here’s the proven framework from our performance-based pricing example that eliminates risk for both parties:

Tier 1: Base Fee (60-70%) Covers your costs and baseline value. This isn’t charity – you’re still getting paid for your expertise and proven methodology.

Tier 2: Performance Bonus (20-30%) Tied to specific, measurable outcomes you can directly influence and control.

Tier 3: Upside Share (10%) Percentage of growth or savings you generate beyond baseline expectations.

Why This Structure Works:

- For clients: Guaranteed value at the base level with explosive upside potential

- For you: Cover costs while positioning for exponential returns based on real impact

The Complete Performance-Based Pricing Example Breakdown: $4M Problem = $750K Solution

Let me walk you through exactly how this performance-based pricing example played out, because the details make all the difference.

The Challenge: The enterprise client had operational inefficiencies costing them almost $4 million annually. Instead of pitching a traditional $50K consulting project, my client proposed this structure:

- Complete diagnostic work at no charge

- Take 20% of documented savings for the first year

- Zero payment unless the problem was solved completely

The Results:

- Fixed the problem and saved them $3.75M annually

- Earned $750K (20% of verified savings)

- Client achieved $3M net win with zero upfront risk

- Project completed in under two weeks

When Performance-Based Pricing Makes Sense (And When It Absolutely Doesn’t)

Not every situation calls for performance-based pricing. Here are the three critical signs it’s right for your business:

✅ Sign #1: You Have Proven, Repeatable Frameworks

You need systems that consistently drive results – methodologies you’ve tested and refined across multiple clients. In our performance-based pricing example, the consultant had a repeatable data optimization process with documented success.

Red Flag: You’re still figuring out your methodology or this represents experimental work.

✅ Sign #2: The Client Has Clear, Measurable Goals

Your client must be willing to tie compensation to specific, quantifiable outcomes. Cost savings, revenue increases, efficiency gains – things you can measure objectively without ambiguity.

Red Flag: Vague goals like “brand awareness” or “market positioning” that can’t be clearly measured.

✅ Sign #3: You Control Enough Variables for Success

You need direct influence over the outcome, not dependence on external factors beyond your control.

Red Flag: Success depends heavily on client team execution, market conditions, or factors you can’t directly impact.

How to Structure Performance Contracts Without Getting Burned

The difference between a profitable performance-based pricing example and a complete disaster comes down to meticulous planning. Here’s your protection framework:

1. Document Current State Obsessively

Before you change anything, create an irrefutable baseline. Screenshots, reports, third-party audits – whatever it takes to establish “this is exactly where we started.”

Why This Matters: Prevents disputes about how much improvement you actually delivered.

2. Define Success in Writing (Before You Start)

Not just revenue targets – but timeline, measurement methods, and contingency plans for external factors.

Include specifics like:

- Exact calculation methodology

- Who measures what, when, and how

- How to handle market changes or team turnover

- What constitutes “completion” of your work

3. Build in Minimum Thresholds

Only trigger performance bonuses when results exceed meaningful baselines. This protects you from small improvements that don’t justify the risk structure.

Example: “Performance bonus applies only when savings exceed $500K annually”

4. Set Clear Time Boundaries

Define exactly how long the performance measurement period lasts. Typically 12-24 months for percentage shares, depending on your type of work.

Why This Matters: Prevents indefinite payment obligations or disputes about when “results” should be measured.

The Psychology Behind This Performance-Based Pricing Example

Performance-based pricing works because it completely flips the traditional consultant-client dynamic. Instead of “pay me and hope for results,” you’re confidently saying “let me prove value first.”

What This Communicates:

- Supreme confidence in your proven methodology

- Complete alignment with client success (not billable hours)

- Lower risk than traditional consulting approaches

- Laser focus on outcomes over activities

The Competitive Advantage: While competitors pitch hourly rates or fixed projects, you’re offering shared success. This positions you as a true strategic partner, not just another vendor.

The Strategic Positioning Component: Why This Client Was Ready

Our performance-based pricing example only worked because we built the positioning to back it up. Here’s what made the $750K contract possible:

1. Category-of-One Expertise

We positioned him not as “a data consultant” but as “THE data consultant for enterprise operational efficiency.” Narrow, specific, defensible.

2. Proven Methodology

His data optimization framework became a reusable asset – something he could confidently bet on across multiple clients.

3. Risk-Absorption Confidence

Strong positioning gave him the confidence to absorb client risk because he knew his system worked consistently.

The Lesson: Performance-based pricing isn’t just a payment structure – it’s a positioning strategy that demonstrates unshakeable confidence in your value delivery.

Your Performance-Based Pricing Readiness Assessment

Before you consider your own performance-based pricing example, honestly evaluate these critical factors:

Do You Have:

- A proven, repeatable methodology for your service?

- At least 3 successful case studies with measurable results?

- The ability to measure and document outcomes objectively?

- Control over the key variables that drive success?

- Financial runway to wait for performance payments?

Does Your Client Have:

- Clear, quantifiable problems you can solve?

- Decision-making authority to approve non-traditional contracts?

- Willingness to share upside when you deliver results?

- Systems in place to measure the outcomes you’ll improve?

If you can’t check most of these boxes, stick with traditional pricing until you can build this foundation.

The Implementation Roadmap: Creating Your Own Performance-Based Pricing Example

If you’re ready to test performance-based pricing, here’s your step-by-step approach:

Phase 1: Build Your Foundation (1-2 months)

- Document your methodology and proven results

- Create case studies with specific, measurable outcomes

- Identify your “minimum viable improvement” thresholds

Phase 2: Find the Right Opportunity (1 month)

- Target clients with quantifiable problems (cost inefficiencies, revenue gaps)

- Focus on prospects who’ve tried traditional consulting unsuccessfully

- Prioritize relationships where you have established credibility and trust

Phase 3: Structure the Deal (1 week)

- Use the 3-tier structure (base fee + performance bonus + upside share)

- Document everything: baseline, measurement methods, timelines, thresholds

- Include clear exit clauses and dispute resolution processes

Phase 4: Deliver and Document (Ongoing)

- Track progress obsessively with shared dashboards

- Provide regular updates showing improvement trajectory

- Build this success into your next performance-based pricing example positioning

What Changes When This Becomes Your Story?

This performance-based pricing example wasn’t just about money – though $750K in two weeks certainly didn’t hurt. It was about the strategic advantage of positioning yourself as someone who stands behind their work with absolute confidence.

Performance-based pricing isn’t right for everyone. But when it’s right, it creates a competitive moat that traditional consultants simply can’t cross.

The deeper principle: When you have proven systems, clear positioning, and unshakeable confidence in your value delivery, you can restructure entire market dynamics in your favor.

What’s your next move?

Ready to engineer your own growth breakthrough? I am taking on 1 new client for next month – drop your details in this form and let’s look to see if we’re a fit.

Want more strategic insights like this delivered weekly? My growth frameworks have helped tech startups scale from pre-revenue to $6M+ ARR by building predictable, data-driven systems instead of hoping marketing tactics work. Join my private newsletter here.

FAQs

What is Performance-Based Pricing?

Performance-based pricing is a compensation model where you get paid based on measurable results you deliver, not just time spent or deliverables completed. Instead of charging traditional hourly rates or fixed project fees, you’re essentially betting on outcomes – taking on shared ownership of your client’s success.

Think of it as moving from “pay me and hope for results” to “let me prove value first, then get rewarded based on actual impact.” You’re not selling time or tasks; you’re selling measurable business improvements like cost savings, revenue increases, or efficiency gains.

This approach demonstrates absolute confidence in your methodology while positioning you as aligned with client success, not just another vendor. When structured correctly, it covers your costs while creating exponential upside potential based on real value delivered.

How Does the Performance-Based Pricing Model Work?

The most effective approach uses a 3-tier structure that eliminates risk for both parties:

Tier 1: Base Fee (60-70%) covers your costs and baseline value delivery – what you’d typically charge for the methodology, expertise, and professional execution. This is paid regardless of performance outcomes.

Tier 2: Performance Bonus (20-30%) is tied to specific, measurable outcomes you can directly control. This only triggers when results exceed meaningful baselines, often with graduated tiers like 10% at 50% target achievement, 20% at 75%, full 30% at 100%+.

Tier 3: Upside Share (10%) provides percentage participation in growth or savings beyond baseline expectations, creating long-term alignment with exceptional results.

Critical success factors include documenting baseline measurements obsessively, defining success criteria in writing with exact calculation methodology, building in minimum thresholds for meaningful improvements, and ensuring you control enough variables to directly influence outcomes.

Do You Have More Performance-Based Pricing Examples?

Performance-based pricing works across multiple industries where outcomes are measurable. Sales optimization consulting might use $45K base + 15% of revenue increase above baseline for 18 months instead of a traditional $75K fixed fee.

Marketing efficiency projects could structure as $25K base + $50 per qualified lead above current baseline for 12 months, while operational cost reduction might use $35K base + 25% of annual cost savings verified by third-party audit.

The model thrives in operations consulting (cost savings, efficiency improvements), sales training (revenue increases, conversion improvements), marketing strategy (lead generation, customer acquisition cost reduction), and technology implementation with measurable productivity improvements.

What makes these examples successful is having quantifiable outcomes that can be measured objectively, direct consultant influence over key variables, established baselines for comparison, client systems capable of measuring improvements, and meaningful impact potential that justifies the contract complexity.